Open Banking

Open Banking App Ideas: Use Cases for Fintech Founders

How will retail bank revenues grow with open banking's triumphant emergence? BCG forecast that retail bank revenues worldwide will grow by 2.8% to $2.59 trillion in 2024, compared to $2.25 trillion in 2022. At worst, the figure will fall by 1.1% to $2.13 trillion. In addition, analysts from both BCG and Bain noticed that retail fintech banking app users loyalty decreased during the pandemic: more and more people are purchasing financial products from different financial institutions.

Among the reasons for this decision, users cite the cost of the product, improved digital solutions, ease of purchase, and ease of use of the competitor's solution. As a result, the fintech startup ideas boil down to a need for a customer-centric bank. And everything suggests that banks should become regulated SaaS companies, and the entire retail banking infrastructure should turn into transparent corporate software.

Open Banking App Ideas: What are PSD2, Open Banking, and Open Banking API?

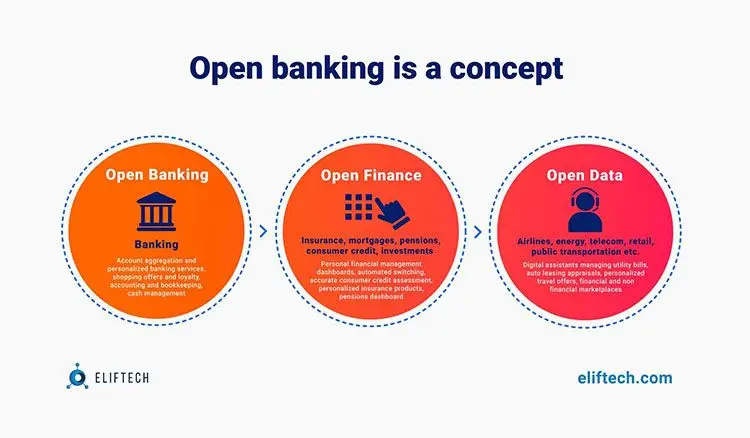

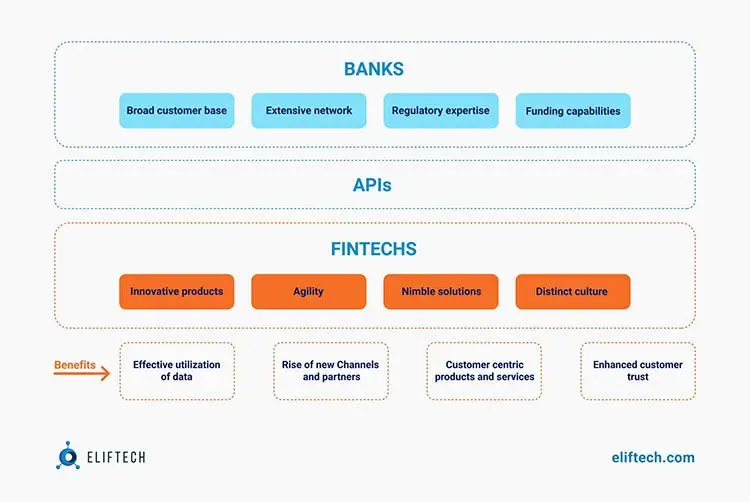

Open Banking is a concept you can use to create your ecosystem. Banks open access to data and services to third-party companies (third-party providers) in such an ecosystem, which, in turn, can use the data to analyze and distribute products. One of the key advantages of Open Banking is the "deployment" of the fintech banking app service by the client and the ability to offer them more services in a more convenient format. Thanks to Open Banking, the fintech market is also developing - for third-party companies, entry barriers to the financial industry are reduced, and competition in the market is stimulated.

Open Banking is based on Open Data and Open API. Open Data is the principle of open access to data. Such data - be it exchange rates and lists of ATMs or depersonalized transaction data - is accessed by external developers from other mobile app development companies. API (application programming interface) is a programming interface that allows one computer program to "communicate" with another. Open API, in turn, is a publicly available set of software tools that provide interaction between applications, boosting the whole app ideas creation. Thanks to open interfaces, not only your mobile app development company but also third-party developers can access the functionality and content of a particular resource and use it, for example, for partial integration or creating their applications.

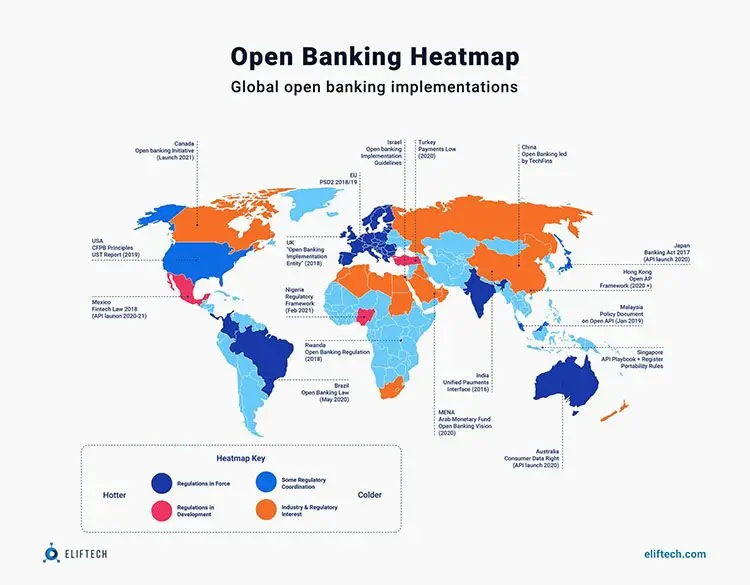

PSD2 is a directive developed by the EU. All European banks must provide open access to their APIs to stimulate competition between banks, FinTech startups with bold fintech app ideas, and other financial services companies. Moreover, the directive is intended for those who use such services (individuals and legal entities) to provide them with new opportunities for managing financial resources.

The PSD2 and Open Banking approach is a big step forward for those wishing to enter the banking and financial services market as a third-party service provider to offer innovative payment methods, lending apps, and other services. Previously, only banks had the right to provide secure payment services. The only competence was to manage customers' accounts and additional financial information. As a result, the banking sector was a monopoly with very strict entry barriers. Now with Open Banking, all doors are open to new innovative fintech app solutions (provided that banks adhere to the standards of the Open Banking API).

The forward-thinking fintech startup ideas follow one rule - every bank located in the European Union is obliged to give access to the financial data of its customers and payment channels through API that they have to share with the world. The API of all European banks should be brought to a single standard, according to the directive. However, this condition turned out to be another challenge - more than two years have passed since the direction was adopted. Nevertheless, the number of banks successfully adapting their APIs to the new conditions could be much bigger.

In the US, there is no state regulation of open banking APIs. However, the favorable financial environment led to the creation of Mint, a banking aggregator company whose website has already been used by about 20 million people in the US and Canada. In Singapore, the Monetary Authority (MAS) supports the principles of an open banking API. Accordingly, the Association of Banks of Singapore (ABS) and MAS, one of the leaders in personal finance management, have launched Finance-as-a-Service: an API Playbook that provides information and guidance for the financial sector to enable efficient financial information sharing and set the stage for innovative banking projects.

In India, an open API India Stack information platform was created. It includes such systems and services as Aadhaar, the world's largest digital biometric identification system, the National Payments Corporation of India, Digital locker, a platform for generating and verifying documents in digital form, etc. IndiaStack allows any mobile app development company or tech startup to enter the mobile application market to identify and authenticate financial service users.

Benefits Open Banking Brings to the Users and Fintech Startup Founders

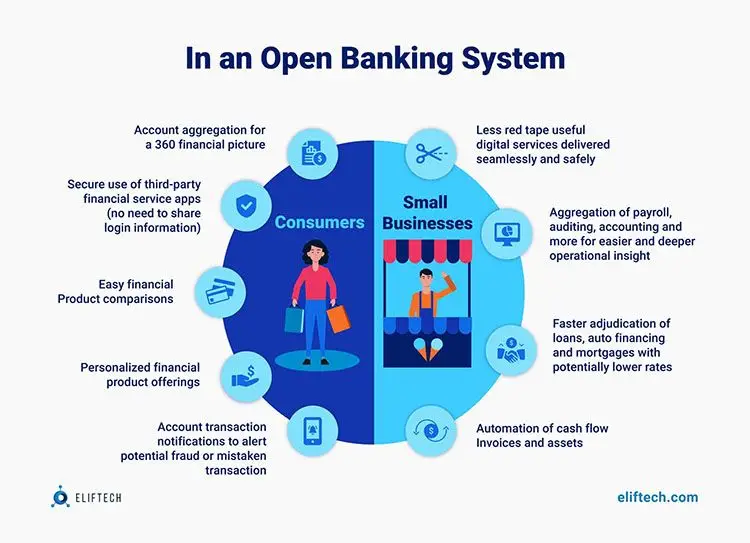

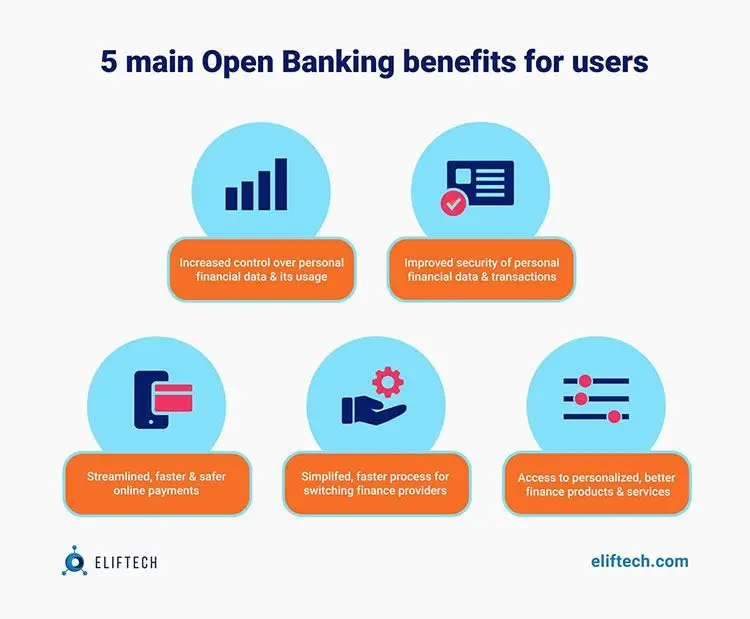

Speaking about the overall benefits to society and the economic benefits that open banking will bring, we can highlight the following:

- More intense competition in financial services. Now anyone who receives a special license from the competent authorities can offer their products with financial management or account analysis functions.

- Push for innovation. PSD2 is an additional motivator for fintech research and amazing products. There are no restrictions - any startup, the emergence of which was previously impossible due to the strict conditions for entering the financial and banking sector, can now become a reality.

- Improved security measures for the financial data of individuals and legal entities. All financial transactions and other actions, like gaining access to account information, can only be carried out with the account holder's permission. In other words, people are now fully responsible for their funds. Previously, the responsibility for the complete safety of funds lay with the banks. This feature has drawbacks, as consumers must be as careful as possible when issuing access to third-party financial services companies. Moreover, with the advent of Open Banking, the number of scammers will also grow.

- Proper financial management. Thanks to PSD2, all economic activities will be more transparent. It will be possible to trace sources of funds and find out where they were spent. Fintech startups will allow the automatic structural analysis of all payments and irregular payments to save money. Businesses will control their cash flow better.

- Debt management. Users can take advantage of fintech products that will analyze all their debts, notify them when they are due, make automatic payments, or even offer a bill reminder app or lending apps with timely reminders. Moreover, based on the results of the solvency analysis, innovative applications will be able to select banking products with the most appropriate interest rates and other conditions according to user preferences and goals. Businesses can also benefit from finding the most suitable overdraft and loan terms.

- Account data aggregation. Users can see data on all their open accounts in different banks and countries in one application.

Open Data Use Cases for FinTech

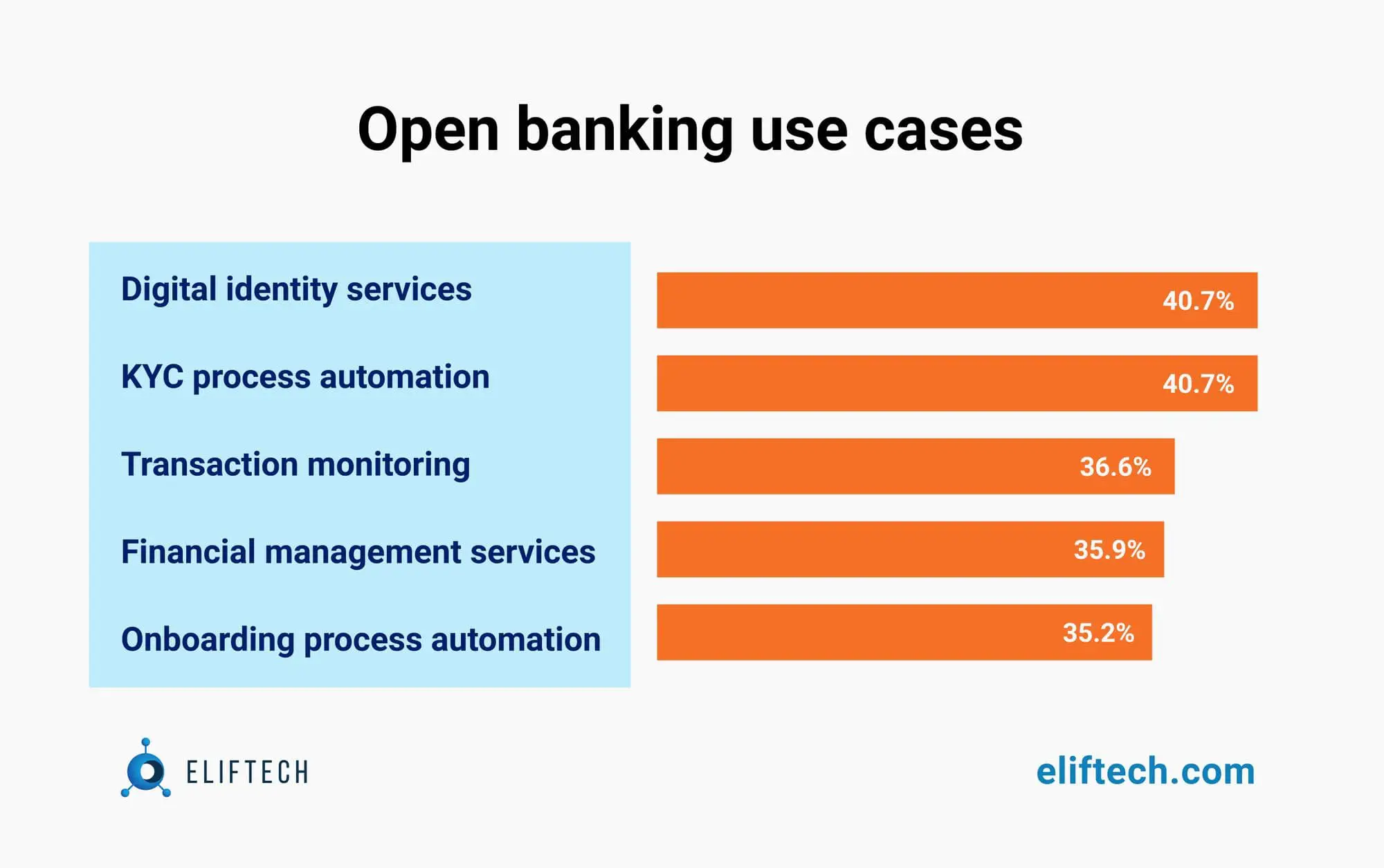

KYC process automation

KYC is a regulatory requirement and standard in banks and the financial services industry that follows AML rules. KYC includes client identification, financial crime security, AML checks, and assessing the client's knowledge and risk tolerance.

Collecting customer information serves two purposes. The first one is to protect the financial institution by verifying the client's identity and identifying the investment and risk profile the client is related to, which allows advisors to serve the client properly. The second goal is to protect the client by providing the necessary knowledge and limiting the client's liability through due diligence.

The KYC process can be narrowed down to 5 steps to improve compliance and avoid fraud:

- Gather information

- Verify documents

- Verify Information

- Start remediation

- Approve processes

Digital Identity Services

Digital identity services help organize an enhanced ID verification process on any platform: mobile, web, or passport readers. It fully automates the reading and verification of personal data in passports, ID cards, driver’s licenses, visas, and other identity documents.

The combination of a contemporary technology stack and deep document analysis makes it possible to detect and fight fraud at its early stages, no matter how old or new the ID format is. To prevent identity theft and fraud, financial institutions require technology solutions that are secure, reliable, and compliant with various regulations:

- Customer identification program (CIP)

- Know your customer (KYC)

- Federal Financial Institutions Examination Council (FFIEC)

- Anti-money laundering (AML)

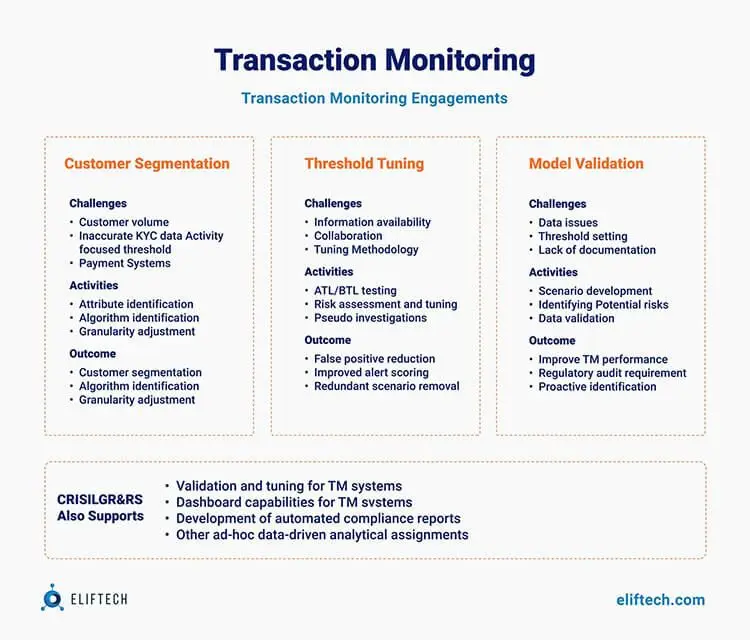

Transaction Monitoring

According to statistics, the number of transactions with bank cards increases by about 14% annually. This is largely due to the introduction of biometrics and contactless payments. However, there are still problems. One of them is a false alarm of the security system when the cyber protection of the bank mistakes a completely legal payment for fraud. And here, everything is not so simple since fraud related to online and mobile transactions accounts for about 93% of cases associated with unauthorized withdrawals of funds from customers' cards.

For high-quality servicing of client transactions, behavioral data analytics is used. An important part of this type of analytics is artificial intelligence, which, in combination with Big Data, machine learning, customer device security control technology, biometrics, transaction monitoring, and data management technology, allows to:

- Collect data about the behavior of users on the network and use this data to analyze ongoing transactions.

- Monitor and analyze ongoing operations in real time.

- Introduce anti-spoofing (verification of user messages to avoid fraudulent actions by intruders).

- Use anti-fraud (assessment of the "legitimacy" of transactions).

- Detect fake documents, including those processed using Adobe Photoshop.

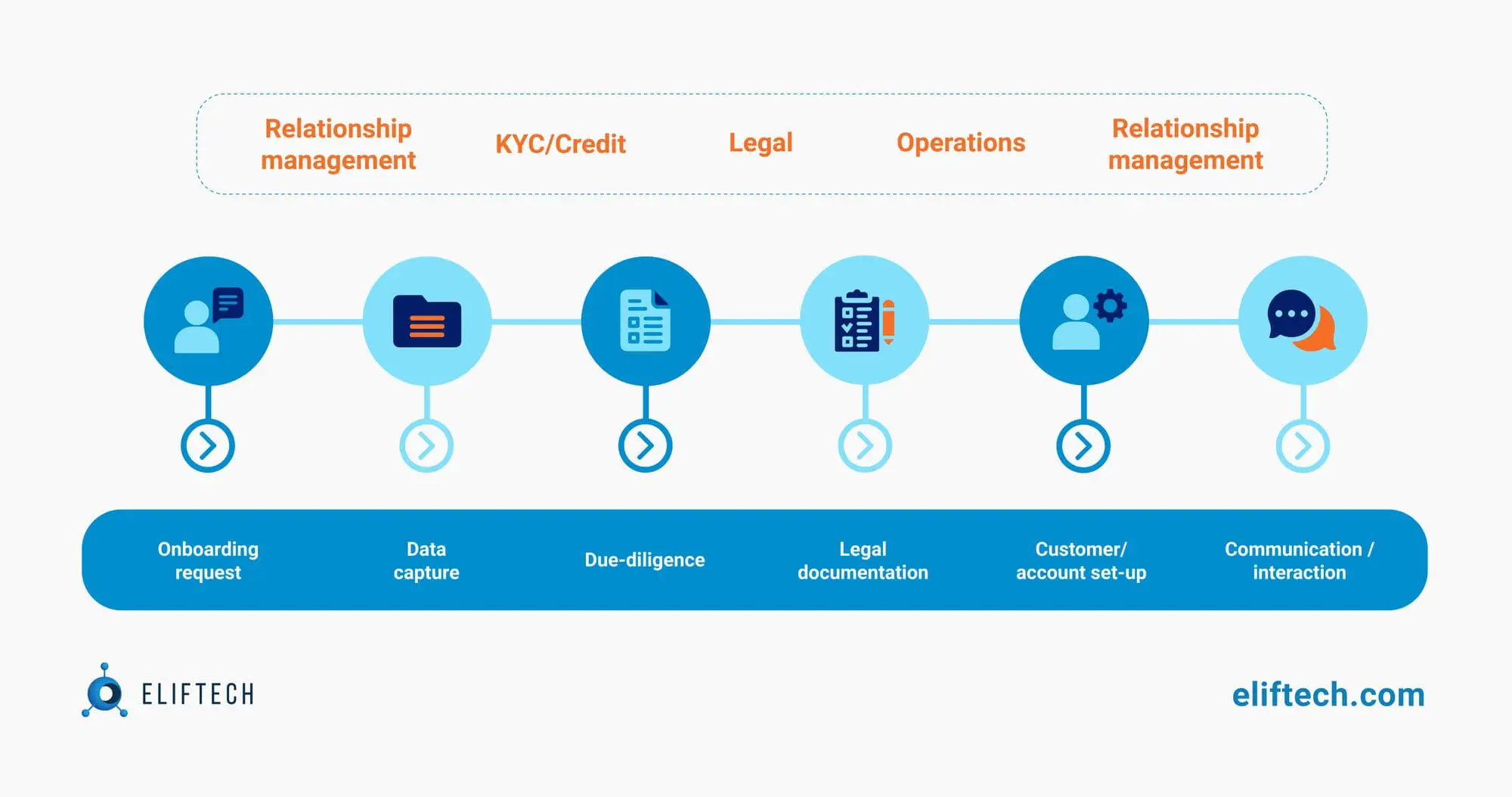

Onboarding Process Automation

The onboarding process for financial institutions is one of the most important bottlenecks in acquiring new customers, affecting the app ideas consideration process. Open banking has the potential to remove many of the hurdles new customers face – like having to fill in long applications that require them to dig up financial information hard to access or submit notarized copies of documents.

Open banking can help users automatically fill these applications by aggregating their data, reducing the hassle and stress. This makes the onboarding experience a lot smoother. Therefore, this methodology is actively used:

- For optimization of control systems

- To reduce errors in the document flow

- To simplify the preparation of final reports

Financial Management Services

Open banking can revolutionize consumer money management and financial planning for businesses by aggregating financial information from different accounts and banks. As a result, consumers get more value from personal finance management apps that can show the full picture of their personal finances – which are often scattered across other accounts. And businesses save time and money by being able to assemble financial information from different banks across various jurisdictions into a single information system in a fast, intuitive, and transparent way – without the need to export and consolidate the data using standardized formats.

Multi-Banking Services

Today, one of the most sought-after capabilities is a single banking or payments interface built in the personal finance management sector that lets users manage their personal finances. However, users must use separate apps or interfaces to deal with accounts at different banks. A multi-banking solution helps users manage all their bills and initiate payments in one place. In addition, it lets banks and PSPs provide an environment where they can own the entire banking experience.

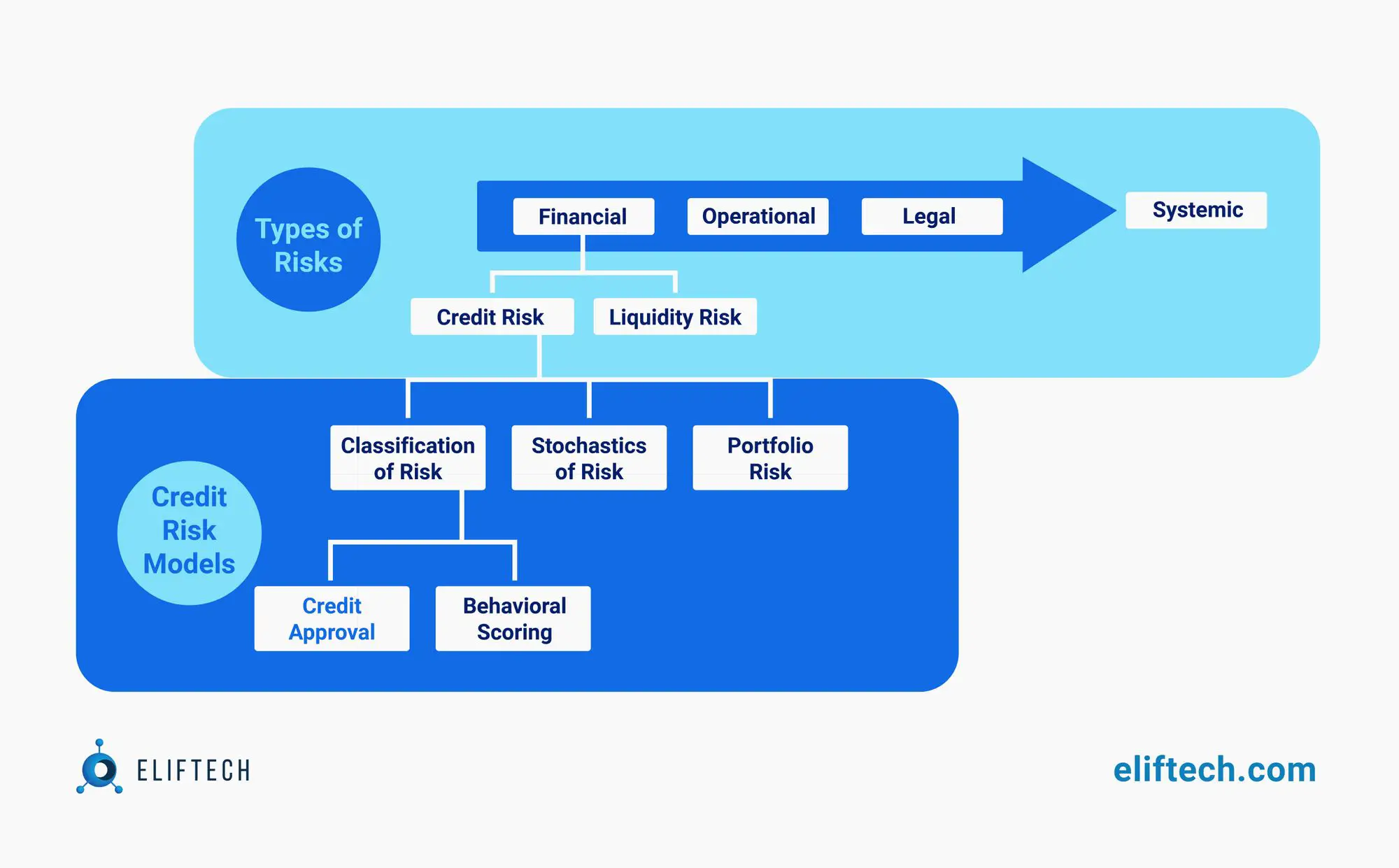

Risk Scoring Algorithms

Account information aggregation allows calculating various risk scores – from applicant's credit history and credit risk to insurance risk or health risks by analyzing spending habits. Then, depending on the service at hand, it can dramatically accelerate the onboarding for a service process.

Income Verification Services

Many financial companies need to be able to verify a client’s income to assess whether they are eligible for a particular service. It's also an important component of risk assessment. Therefore, today's demand for new app ideas is also driven by the need to verify applicant's credit history and income effortlessly. By verifying income, salary, and potentially even employer, financial institutions can design services that are better, quicker, and more tailored to the individual.

Subscription Management Services

An emerging use case is where a financial institution operates as a concierge and helps the user by renegotiating subscription fees, activating new subscriptions, or canceling subscriptions on the customer's behalf.

Neobanks Expand Product Lines: What Can You Do with Open Banking?

Exton Consulting experts have calculated that today more than 50 million Europeans use the services of neobanks. They also showed the life cycle of challenges. They concluded neobanks urgently need to revise their business models and offer additional products to become profitable. Fintech was doing it in January.

An ambitious fintech startup ideas generator Zopa offered users to compare energy prices from different companies and, if desired, change the supplier directly in the application.

French SME Neobank Anytime can provide loans and insurance to its customers after being acquired by Orange Bank.

JPMorgan Chase decided to launch its Chase Neobank in the UK fintech market, even though such an idea did not take off in the US. In addition to checking accounts, Chase will eventually offer credit cards, lending apps, mortgages, auto loans, and other products.

Almost immediately after Brexit, Europe and the UK found themselves in a position where the international payment system Mastercard announced that it would increase the commission for transactions by five times when British people make purchases in European online stores. As a result, credit card fees will increase from 0.3% to 1.5%, and debit cards - from 0.2% to 1.15%. In addition, Mastercard treats payments between the UK and the European Economic Area as interregional. Compared to such events, alternative prices without intermediaries have seen more action with different mobile app development companies. Not without reason, Juniper Research predicts that the number of QR code payment users will exceed 2.2 billion by 2025.

- Already, the British neighbors have begun to unite: the four largest Irish banks announced the creation of a multi-bank payment solution, Syntech Payments, based on the fintech app solutions of the Italian Fintech SIA. Another example is when the TrueLayer API platform launched the PayDirect payment service, allowing fintech, banks, and businesses to quickly identify users in compliance with all KYC procedures and then make payments directly between bank accounts. At the same time, the failure rate for transactions is only 3.5%, while for bank cards, this figure reaches 15%.

- A week later, it became known that American PayPal bought the Gopay service and became the first foreign company to provide digital payment services in China.

- Checkout.com has tripled its valuation to $15 billion after raising a $450 million Series C investment. The company, which provides processing services to Klarna, Revolut, Transferwise, eToro, and Coinbase, is now the fourth-largest fintech in the world.

- Nubank entered the top 5 financial institutions in Latin America and became one of the largest banks after attracting $400 million in investments. As a result, the Brazilian Neobank mobile app development company's market evaluation has risen to $25 billion.

- Rapid raised $300 million from investors in a Series D round led by Coatue. The funds will be used to expand the team and scale the business.

- A little less - $165 million - was received by the American fintech Divvy, which offers businesses free expense management software and corporate credit cards. The $110 million figure united the German banking SaaS platform Mambu and the American payment service for small companies Melio. It is these investments that attracted each of the fintech. Mambu plans to conquer Brazil, Japan, and the USA with this money, and Melio will develop functionality and partner solutions.

Instead of "Afterword,": A Brief “Open Banking Landscape”

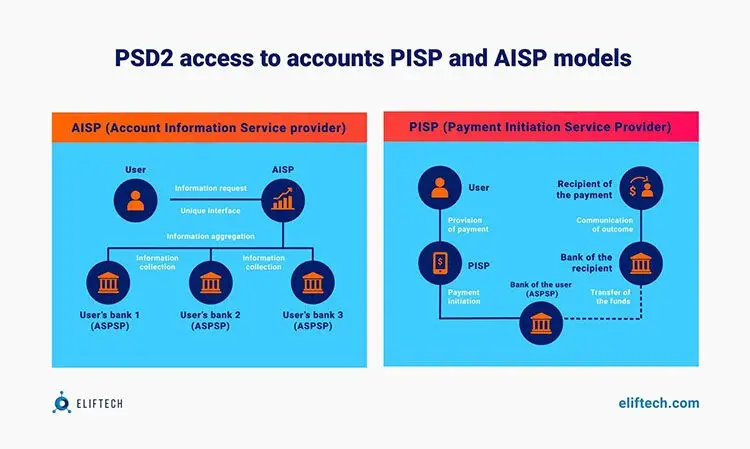

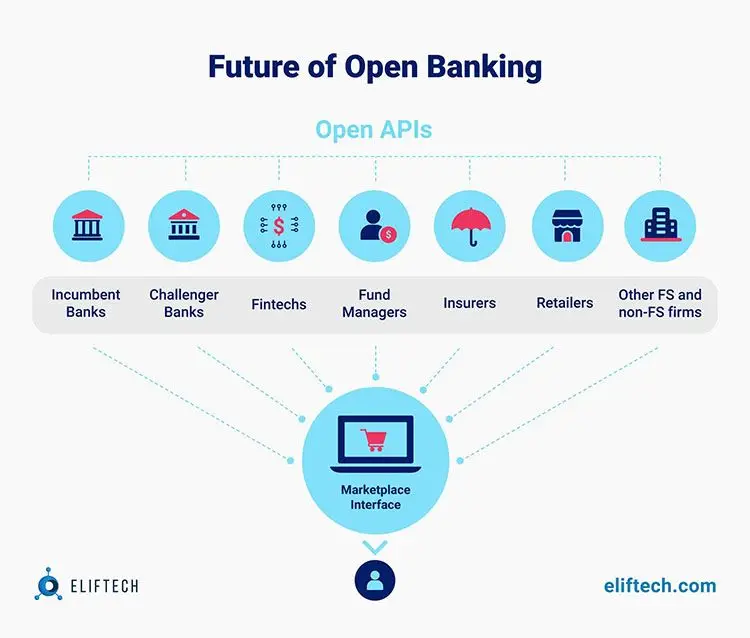

And now, the information for those who are hatching fresh fintech ideas and want to become a leading financial services provider and reap the benefits of open banking. According to the PSD2 directive, financial services companies (i.e., those who want to enter the market with their products) will be classified into two large groups:

- AISP (Account Information Service Provider) – a high-level mobile app development company can provide such services to develop products that request access only to banking data and do not require permission to make payments. Such products work with information (analyze it and make recommendations regarding financial behavior), support decision-making regarding banking products, and aggregate data from several bank accounts and other financial sources (for example, cryptocurrency wallets) in one place.

To illustrate, here are examples of some existing AISPs: Moneyhub collects data from all user bank accounts in one application working as savings, trading, and investment apps and allows users to categorize their spending, set goals, and receive recommendations from experts; Fractal - serves as a financial assistant for businesses, analyzing all financial assets, generating reports and preparing forecasts. - PISP (Payment Initiation Service Provider) - a product from a mobile app development company that provides data services and makes various kinds of payments on behalf of the user – of course, only after they have given their consent to this. Curious examples: Squirrel - creates a separate account where the application stores the user's funds, and from this account pays bills and loans and issues a fixed amount of money for a week to help users avoid unnecessary spending; Moneybox - withdraws small amounts of money to make micro-investments. Both fintech startup ideas are geared towards saving money for the future than spending it today on the fifth cup of coffee.

Of course, financial app ideas can combine the functions of AISP and PISP. A successful example is the Chip project, which uses machine learning algorithms to analyze user spending from all bank accounts. It also transfers a certain amount to the savings account. All this sounds interesting, but let's look at it from the banks' point of view. First, the open banking approach will have a massive effect on the global banking industry:

Banks will be more motivated to create the best products to meet modern society's needs. Otherwise, they risk losing a substantial number of their customers. The competition is expected to be bigger than ever in a couple of years, so banks will have to learn how to adapt to survive in the post-PSD2 era. Since many people often complain about their mobile and web banking products, customers will increasingly use innovative fintech solutions with a friendly interface.

The consequence of the events described in the previous paragraph will be that the IT costs in banks will increase significantly, especially as they need to standardize and make their APIs public. The problem can become even more pressing if banks consider that working with APIs is something they can handle on their own and, as a result, choose not to turn to competent experts who can do everything right from the start and in shorter terms. In addition, banks will also need to adapt their business processes to the new security requirements dictated by PSD2.

What is the future of open banking? Due to total digitalization and unification, we expect PSD2 and open banking to become revolutionary for the US and European markets within the global fintech market. In addition, working groups are currently being created in the CIS countries to form regional analogs of open banking.

FAQs

Browse our case studies and get actionable insights to drive your success

See more