ML

Main Use Cases of NLP in Finance Sector

With the development of advanced technologies, the world of fintech is gradually changing. Today, businesses are forced to compete with each other, and clients no longer have time for uncertainty. Artificial intelligence and Natural Language Processing (NLP) are one of the most beneficial and popular technologies in finance today. So, let’s discuss what NLP is and how it can be used in Fintech Industry.

Table of contents:

- What is NLP, and how does it work?

- Main tasks of NLP.

- NLP in Fintech world: how is NLP used in finance?

- The Numerous Benefits of NLP in Fintech

- Workflow automation

- Smart search and document analysis

- Fraud prevention

- Credit scoring

5. Voice recognition

6. Why is it the best time to invest in NLP solutions?

7. Final Thoughts

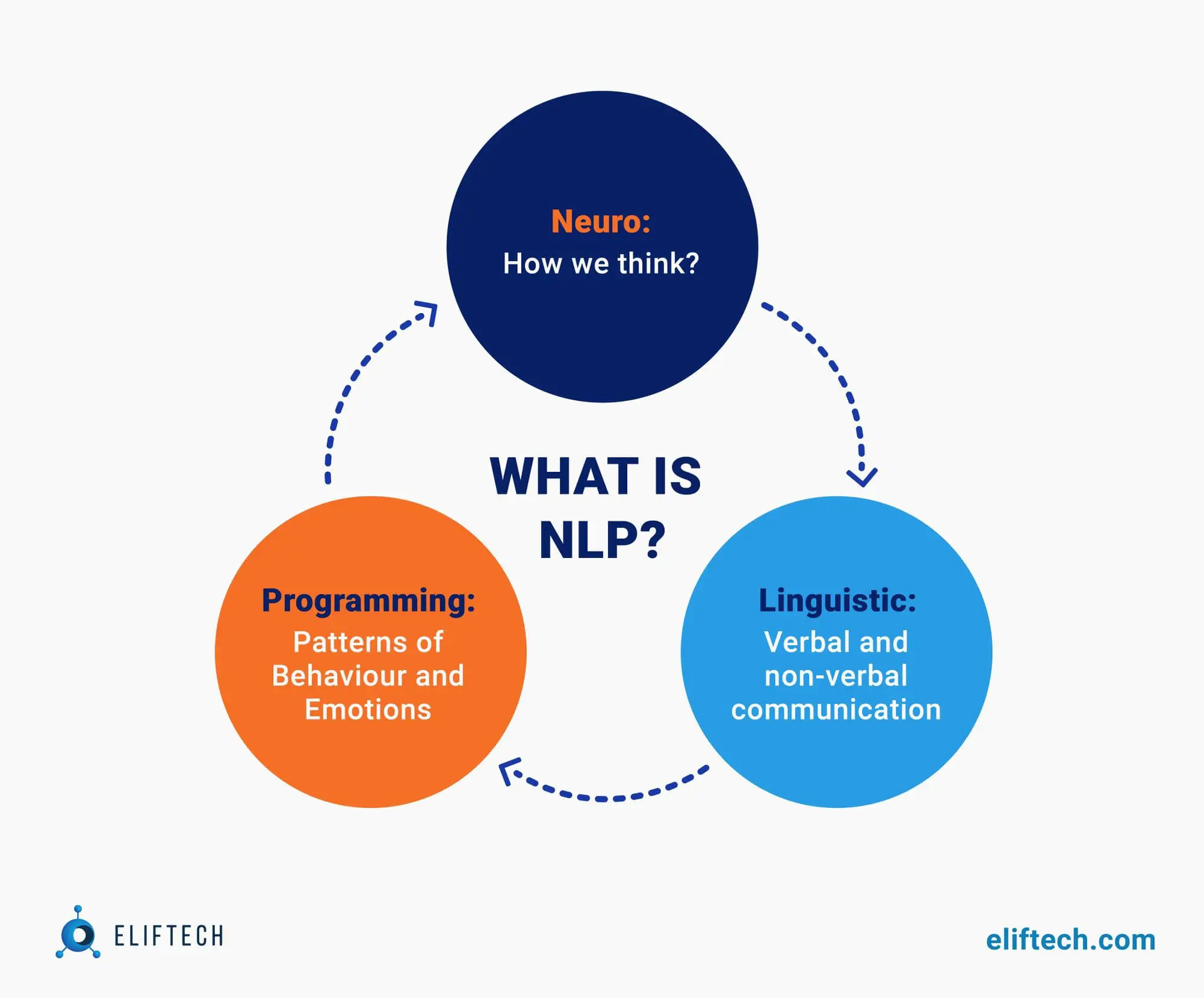

What is NLP and how does it work?

NLP, or Natural language processing, is a subfield of artificial intelligence (AI) that aims at analyzing, deriving, and understanding written and spoken human language by computers. This technology is designed not only to understand the direct meaning of usual languages but also to understand the sentiment and intent of the words. Basically, the computer has to link words and concepts to create the meaning of speech. In order to do this complicated process, NLP uses a combination of computational linguistics (rule-based modeling of human language) and statistical, machine learning, and deep learning models. These technologies allow computers to process and understand the meaning of different types of human language (text data or voice data).

In the picture below, you can see how the elements of NLP are connected:

Did you know that you actually interact with NLP every day? To simplify your understanding of this technology, we will provide you with some examples where natural language processing is used:

- Siri, Alexa, or Google Assistant

- Voice-operated GPS systems

- Language Translation

- Email filters

- Search Engine Results

- Chatbots

- Survey analysis

- Predictive texts

- Digital phone calls

- Data analysis

And, of course, NLP technology is broadly used in Fintech, so let’s understand how they are connected and what are the main tasks of this technology.

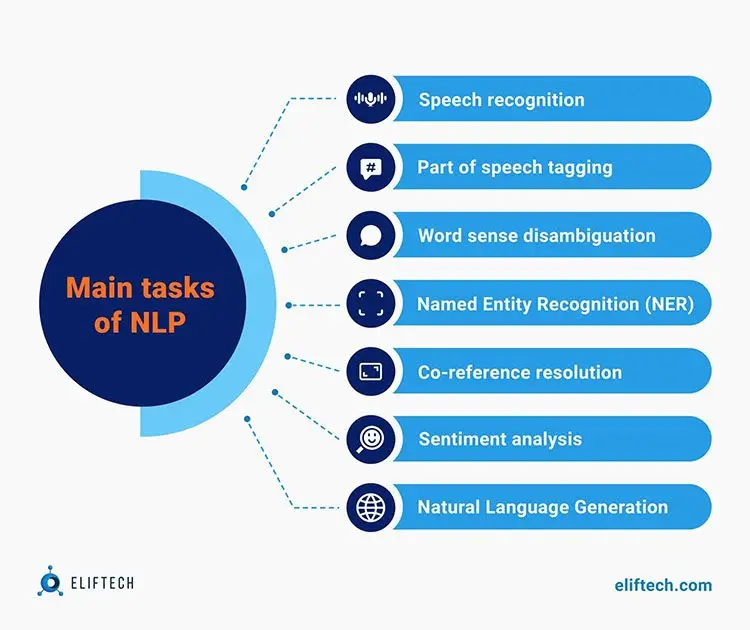

Main tasks of NLP

As we already know, uncertainties in the languages people speak to make it difficult to create software that can accurately determine the meaning of different phrases and collocations in the voice or text data. For example, to create an excellent and valuable NLP application for finance, programmers need to “teach” NLP how to recognize and understand idioms, sarcasm, grammar exceptions, structures of sentences, and metaphors accurately.

So, some tasks of this technology are to structure the text and voice data to help the computer better understand it. In the picture below, you can see the main tasks of NLP.

Let's find out more about each of them:

- Speech recognition (speech-to-text) develops methodologies and technologies that allow computers to recognize and translate spoken language into text. This is a must-have for any app that uses voice commands or answers spoken questions. The most challenging aspect of speech recognition is that people talk quickly, with different accents and intonations.

- Part of speech tagging (grammatical tagging) is when computers can identify the words that act as nouns, pronouns, verbs, adverbs, etc., depending on the context of speech and how the word is used. So, they describe the characteristic structure of lexical terms in the sentence. The part of speech tagging is used for making assumptions about semantics.

- Word sense disambiguation (WSD) is a process of determining the meaning of words based on context. The main difficulty of WSD is deciding the word's sense because different senses can be very closely related. Even different dictionaries and thesauruses can provide different divisions of words into senses.

- Named Entity Recognition (NER) is the process of detecting the named entities from the text. For example, it can be the name of the person, location, company, etc.

- Co-reference resolution is the task of finding all expressions that refer to the same entity in a text. The easiest example is determining the person to which a specific pronoun refers. For instance, "I," "my," and "he" belong to the same cluster, and "Jane" and "she" belong to the same cluster.

- Sentiment analysis allows for identifying the emotional tone behind a body of text (attitude, sarcasm, etc.) Sentiment analysis is a popular way to help organizations determine and categorize opinions about a product, service, or idea.

- Natural language generation (NLG) produces natural written or spoken language from structured and unstructured data. NLG is broadly used in weather and patient reports, image captions, and chatbots.

NLP in Finance world: How is NLP used in finance?

The world of Fintech is developing every day, and the demands of customers are growing too. To provide cutting-edge technologies and services to your clients, you need to know their needs and ways to fulfill them. Artificial Intelligence and NLP as a branch of it enable machines to perform many tasks in a more efficient and quick manner.

Natural Language Processing in Finance has 2 major use cases:

- Understanding human speech and its meaning, determining the intent and emotions.

- Turning unstructured data in databases and documents into structured data (text mining).

So, let’s explore more how NLP can be used in Fintech:

- Sales and CRM Optimization

Mc Kinsey research shows that NLP can be an excellent tool for sales: For example, banks that use it have increased their customer engagement scores and customer acquisition.

Furthermore, NLP in the banking and finance sector can be used in CRM software to minimize the need for manual entries and updates.

- Investments and trading applications

NLP in Investments and trading applications allows financial analysts to get the relevant information through information filtering.

- Virtual and voice assistants

NLP can also be used for virtual assistants. For example, Siri and Alexa use speech recognition that helps to recognize different patterns in voice commands and natural language generation to create a response with relevant comments.

- InsurTech

There are many ways in which NLP can be practical in insurance, But the most popular are:

- insurance claims analysis: NLP can be used in combination with OCR (character recognition) to discover the correct information to process insurance claims and send it to a machine learning algorithm.

- fraud detection: NLP use cases in finance combined with machine learning and predictive analytics can quickly detect fraud and misinterpreted information from unstructured financial documents.

- RegTech

AI is broadly used by Regtech firms to help financial institutions keep up with regulations and monitor client activity for regulatory violations. Benchmark report states that Machine learning and NLP were used by 58% and 50%, respectively, of the 12 central banks using Regtech.

- Cloud-based Chatbots

Artificial intelligence can be used for customer services: you can create chatbots for frequently asked questions to use your employees' time rationally. NLP in Fintech chatbots allows companies to offer automated services with 24x7 availability.

Using artificial intelligence allows many organizations to focus on high-level concerns while leaving tasks better suited to machines free from human workers. Savings and other financial gains are achieved by offering automated services with 24x7 availability, in this way, can be immersive.

The main aspect of using such cloud-based services is that you don’t need technical knowledge to build them. The hardest work is provided automatically, while you will just need to define the scenario of user interaction with your chatbot and provide the source of information for responses.

The Numerous Benefits of NLP in Finance

As we discovered earlier, NLP has many benefits for Fintech:

Workflow automation

NLPs can gather data about a customer's interactions, which can be used to generate sentiment analysis, assess and qualify customer satisfaction, perform pattern matching across thousands of conversations, and detect anomalies in conversations. All of this data can be used to create customer profiles that reflect that customer's evolving situation.

Smart search and document analysis

Modern NLP-based management systems can simplify administration by providing comprehensive report generation, document analysis, and security. Moreover, NLP software can lead clients through the claims process and generate a simple policy approval just in a few minutes. NLP technology can even be used in the analysis of scanned and handwritten documents and transform those documents into new versions.

Fraud prevention

NLP can be a great solution for fraud prevention by analyzing large volumes of data for businesses. Moreover, NLP offspring, Named Entity Recognition, can detect real-life concepts in the text, thus- preventing fraud cases from happening.

Credit scoring

NLP, through conversational chatbots, can quickly evaluate a customer's credit card request by checking their "digital footprint" like social media profiles, browsing history, and geolocation-based travel history. Such an analysis allows for the translation of the data into an accurate credit score.

Voice recognition

Voice recognition is one of the most important technologies in security today. It can be used to identify people or even to categorize the contents of a company's confidential documents.

Why is it the best time to invest in NLP solutions?

NLP technology has been gaining popularity in the recent few years. Thus, many companies emphasize NLP implementation and development as a first-priority task. Also, due to this popularity, the demand increases for the development of NLP-based solutions in different languages. Many of them require more accurate algorithms to come up with good results due to many factors that create complexity. With numerous benefits, NLP has shown itself as a powerful tool for simplifying many processes and a growing technology with great potential for further examination and development.

Final Thoughts

NLP can be an extremely useful technology for many industries, especially for FinTech. To implement NLP-based solutions, you will need to understand what NLP is and how it works, its main tasks, NLP for finance, how NLP can be beneficial, and why it is the best time to invest in NLP solutions.

If you need any guidance on an NLP-based solution for your business or want to develop one, do not hesitate to contact our dedicated team to create a high-quality product from scratch.

Browse our case studies and get actionable insights to drive your success

See more