FinTech

From Open Banking to Sustainable Finance: Future of FinTech 2023 Outlook

The technology industry is constantly evolving, leaving no room for stagnation. With each passing day, modern technologies are steadily replacing traditional practices of managing and servicing the banking and financial industry, pushing the boundaries of innovation.

2023 brought a revolutionary wave of emerging fintech trends reshaping industries and driving innovation. From open banking to green fintech and sustainable investing, these booming trends attract much attention and investments, revealing a vital market need for transparency, security, customization, and improved efficiency.

Backed by our experience in the fintech niche, we’ve compiled a list of mainstream trends that will define the year ahead and shape the future of fintech 2023.

Future of FinTech 2023: Top 10 Emerging Trends

Whether you’re a fintech startup, a seasoned entrepreneur, or a fintech pro, each of the below-listed trends represents exciting developments in the fintech landscape. They deserve closer attention and scrutiny as they shape the future of financial services and improve the overall user experience that customers expect today.

Trend #1: Increased Use of Open Banking

Open banking FinTech trend drives significant advancements in the banking industry. According to Statista, the number of open banking users worldwide is expected to reach 63.8 million by 2024. The concept of the confidential exchange of consumer data with authorized third-party providers drives its wider use.

In turn, customers can access a wider variety of customized services using open APIs while retaining better control over their financial data. On the other side of the spectrum, financial companies adopt this trend to enable using customer data to develop innovative services such as personalized budgeting apps and seamless payment experiences across multiple platforms. Financial businesses dealing with budgeting, financial planning, lending, and other services are among the lucky ones who adopt this emerging FinTech trend and open new opportunities.

For example, FinTech companies such as Plaid and Yodlee have implemented Open Banking APIs to communicate with banks and provide users with a consolidated view of their financial accounts. By using Open Banking FinTech trends, these companies can enhance the customer experience, foster innovation through collaboration with third-party developers, and offer customized financial products and services tailored to individual needs.

Want to know the other side of the coin? Learn more about the challenges open banking faces and how to overcome them.

Trend #2: Growth of Decentralized Finance (DeFi)

Using blockchain technology, decentralized finance, or DeFi, reshapes traditional financial systems to provide transparent and accessible financial services. Both blockchain startups and sustainable financial organizations choose to invest in DeFi to develop a platform allowing users to land, borrow, and trade digital assets without relying on traditional intermediaries. Also, such platforms can utilize smart contracts and decentralized exchanges, allowing transparent and effective transactions and eliminating the need to deal with banks.

The benefits of DeFi for businesses include increased accessibility to financial services, reduced transaction costs, and improved financial inclusion for businesses and individuals. DeFi also allows companies to investigate cutting-edge fundraising strategies like Security Token Offerings (STOs) or Initial Coin Offerings (ICOs) to raise money for initiatives or ventures.

Read more: Get Ready for the Future: An Introduction to NFT Marketplace Development

Trend #3: AI & Machine Learning Adoption in FinTech

Along with the increasing adoption of AI and Machine Learning, the FinTech landscape is already transforming and will keep doing so. That happens due to its overreaching benefits, like enhanced customer service, automated core and non-core processes, and improved risk assessment.

There are multiple applications of this uprising trend, and the major ones are AI-powered chatbots and virtual assistants that provide instant customer support and personalized recommendations.

For example, wealth management companies implement ML algorithms to analyze massive amounts of data and produce investment strategies based on market trends and historical patterns. Another example is a robo-advisory platform like Betterment that use AI algorithms to optimize portfolio allocation, reduce human bias, and offer cost-effective investment decisions.

Read more: ML in Banking: Your implementation roadmap

Trend #4: More Accurate Credit Scoring

Disruptive FinTech innovations transform credit scoring using alternative data sources and advanced analytics. For example, individuals with little or no credit history are excluded from traditional credit scoring because it relies heavily on credit history.

Fintech companies now utilize alternative data, such as utility payments, rental history, or educational background, to provide more accurate credit scoring. By analyzing diverse datasets, company A can make fairer lending decisions, increase loan availability to marginalized people, and lower default risk. In turn, financial businesses can make more informed lending decisions, minimize risks, and promote financial inclusion.

Trend #5: Embedded Finance & API

Businesses can seamlessly integrate financial services into their non-financial platforms through embedded finance and APIs. Businesses can now improve the user experience and provide added value to customers by integrating payment systems, lending options, or financial management tools into their products or services.

According to McKinsey, experts predict the market for embedded financial services will steadily expand and double in size within the next three to five years.

For example, ride-sharing services like Uber allow users to conveniently pay for their rides without switching to an external payment app using in-app payments supported by integrated finance. So, by adopting this trend, businesses gain boosted revenue streams, improved customer engagement, and streamlined processes.

Trend #6: Buy Now Pay Later (BNPL)

BNPL trends in FinTech have gained wide popularity as a payment solution that allows consumers to make purchases and spread the payments over time. For example, companies like Klarna, a leading BNPL provider, provide flexible payment options that divide the total cost into interest-free installments.

By implementing BNPL trends in FinTech, businesses can increase sales among consumers with tight budgets who prefer the ease of scheduled payments. In turn, while giving customers greater spending freedom, the trend provides firms with immediate revenue. Additionally, by resolving pricing issues and enhancing the overall purchasing experience, using the BNPL trend in FinTech can lower cart abandonment rates, ultimately promoting customer loyalty and increasing customer retention.

Trend #7: Green Fintech & Sustainable Investing

Increased awareness of environmental challenges and the demand for ethical financial behavior has caused the emergence of green fintech and sustainable FinTech investment trends. Financial organizations welcome this trend by developing a sustainable investment platform that provides investment options focused on environmental initiatives and socially responsible companies. Adopting green FinTech and sustainable investing aligns businesses with ethical values and provides them with a competitive edge.

This trend mainly attracts investors who care about the environment and want to make money by supporting worthwhile initiatives. In addition, this growing trend allows companies to make valuable social and environmental contributions, encouraging a more sustainable future.

Trend #8: Neobanking

Neobanking stays on top of consumer FinTech trends and keeps gaining momentum by offering innovative and consumer-centric financial services. Neobanks run entirely online, providing secure transactions, convenient account management, and budgeting tools via mobile apps. Businesses can use this trend's more accessible banking solutions, lower operating expenses, and improve financial visibility.

A significant advantage is that neobanks can often be developed from scratch without having an initial client base. They primarily focus on personalized services, user-friendly interfaces, and affordable rates while attracting a new generation of tech-savvy consumers. By implementing neobanking, businesses enhance their cash flow, optimize their financial management, and access cutting-edge tools that help them make better financial decisions.

Read more: Custom Banking Solutions: Revolutionizing Customer Experience in Finances.

For example, Monobank is a Ukrainian-based neobanking app known for its user-friendly interface, consumer-centric, and digital-only banking services. With features like contactless payments, expense tracking, personalized budgeting tools, and real-time notifications, Monobank offers its customers a smooth and hassle-free banking experience through their mobile phones.

Trend #9: Super Apps

Super applications are all-encompassing platforms combining several services and functionalities into one application. One well-known example is WeChat, which incorporates messaging, social media, payments, ride-sharing, and more into a single app.

The future of FinTech 2023 will definitely go hand in hand with super apps, providing companies with a consolidated platform to connect with and interact with customers, increase customer loyalty, and open up cross-selling opportunities. By providing seamless transitions between various services and eliminating the need to navigate between multiple apps, super apps also boost the user experience.

Adopting the super app model can help businesses grow their customer base and retention, increase brand awareness, and provide customers with a smooth, personalized experience.

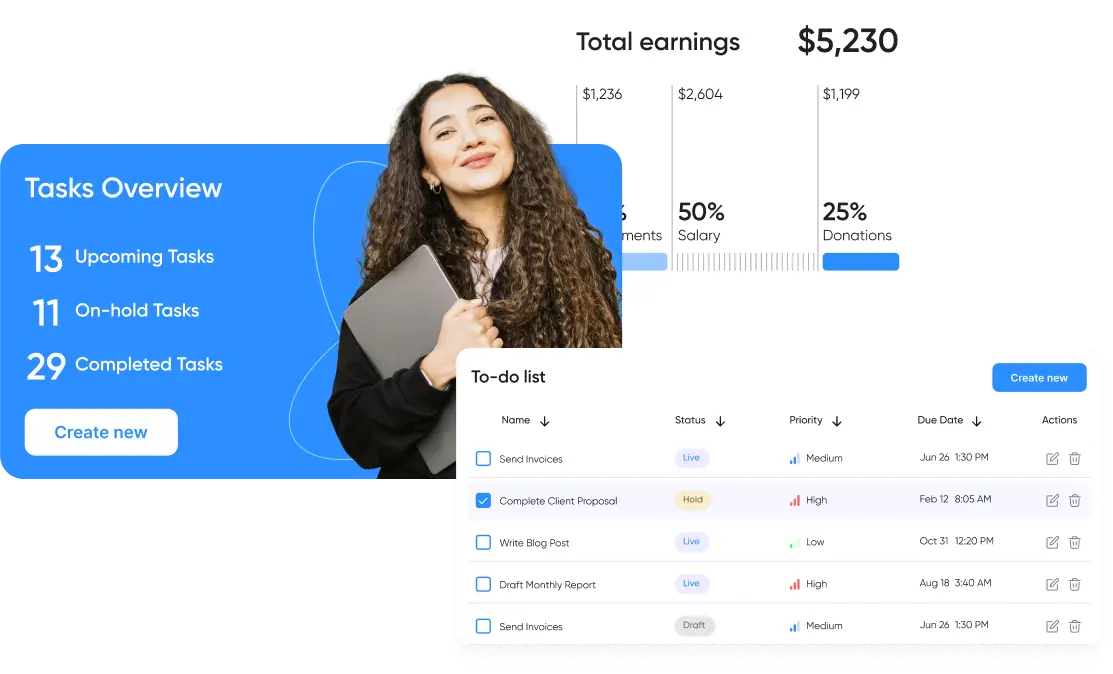

Trend #10: Spend and Wealth Management

Tools for wealth and spending management are gaining popularity since they give people a helicopter view of their finances and enable them to make wise decisions. Companies like Mint, a well-known personal financial app, provide tools to help users manage their money wisely, including budgeting, expense tracking, investment tracking, and goal setting.

These tools help companies access information about consumer preferences, spending patterns, and investment preferences. Businesses can increase customer satisfaction and loyalty by incorporating this information into targeted marketing campaigns, product development, and personalized services. Spending and wealth management tools support responsible saving, investment, and spending habits, promoting financial well-being.

Spend and wealth management emerging FinTech trend will undoubtedly innovate financial services and applications and shape the future of FinTech 2023.

Let’s team up and decide which one of the FinTech market trends will help you grow your business!!

Leveraging FinTech Trends with ElifTech

As a tech-savvy and award-winning Clutch FinTech team, we always keep growing our expertise and keep an eye on new innovations in the FinTech niche. With a solid understanding of emerging technologies, the ElifTech team helps both FinTech startups and well-established companies to stay on top of the financial market and navigate the evolving fintech landscape effortlessly.

ElifTech offers customized fintech solutions that use APIs, automation, and advanced data analysis to provide organizations with the tools they need to stay ahead in the ever-changing financial sector. Our expertise can help you optimize resources and workflows to ensure maximum productivity and cost efficiency without compromising impeccable quality.

Our team consists of expert FinTech developers and designers that already created solutions of varying scales and requirements, from custom open banking solutions to complex legacy software upgrades.

Among the most recent solutions we’ve built and technologies we’ve used are:

- Banking and finance software: web apps powered by cloud computing, web and mobile banking apps, process automation and systems integration, online banking platforms, open banking solutions, online KYC verification, security and fraud detection, legacy software upgrade, UI/UX design for Banking. Learn more about our related ITFin case to dive into the details.

- Trading platforms: automation of trading strategies, trading data analysis solutions, AI-based trading, custom online trading platforms, FIX API solutions, security and fraud detection, and Robo-Advisory development. Get familiar with our relevant case: Trading Algorithms - Low-Code Platform for Automated Trading.

- Mobile payments and digital wallets: eWallets, P2P payments, money transfer platforms, FinTech payment solutions, payment gateways. Check out our relevant case: ClassWallet - Feature-Rich Financial & Payment System.

- Investment management platforms: custom investment platforms, asset tracking, and management platforms, robo-advisors rooted in artificial intelligence, the stock market advanced analytics software, financial data analysis and recommendation, and NLP-based solutions. Discover our relevant case example: Feelcapital - Digital Tool for Investment Management.

- Lending and alternative finances: P2P lending platforms, mobile lending apps, loan sales portals, AI-based credit scoring, and crowdfunding platforms. Examine our case study: Asteria - Cash Flow Management & Forecasting Software.

Choose ElifTech as your FinTech app development partner to drive digital transformation, enhance customer experiences, and improve operational efficiency. Embrace the future of FinTech in 2023 with confidence!

Summary

FinTech trends in 2023 are revolutionizing the industry, with Open Banking and DeFi leading the way. By keeping up with these new trends, businesses can innovate, outperform competitors, and create a more inclusive and sustainable financial future. That ultimately results in an increased customer base, top-quality service, efficiency, and profits - as the most anticipated return on investment.

So, regardless of your project scale, timeline range, and available resources, the ElifTech team is ready to step into this hectic routine to take a heavy burden off your shoulders.

Get in touch with our team and share your pain points.

FAQ

Browse our case studies and get actionable insights to drive your success

See more