Tech Guide

Distributed architecture: how can it benefit your payment system?

When it comes to payment systems, the trend is clear: distributed architectures are here to stay. While some legacy payment systems may still be in place and even new ones continue to be built as centralized systems, the industry is moving toward a world of distributed payment systems that are more cost-effective, flexible, and scalable than ever before.

In this article, we will delve into the core principles and strategies that make distributed payment systems so unique and powerful; explore how distributed architecture can be used for payments and look at several successful implementations of such systems.

Overview of Distributed Architecture

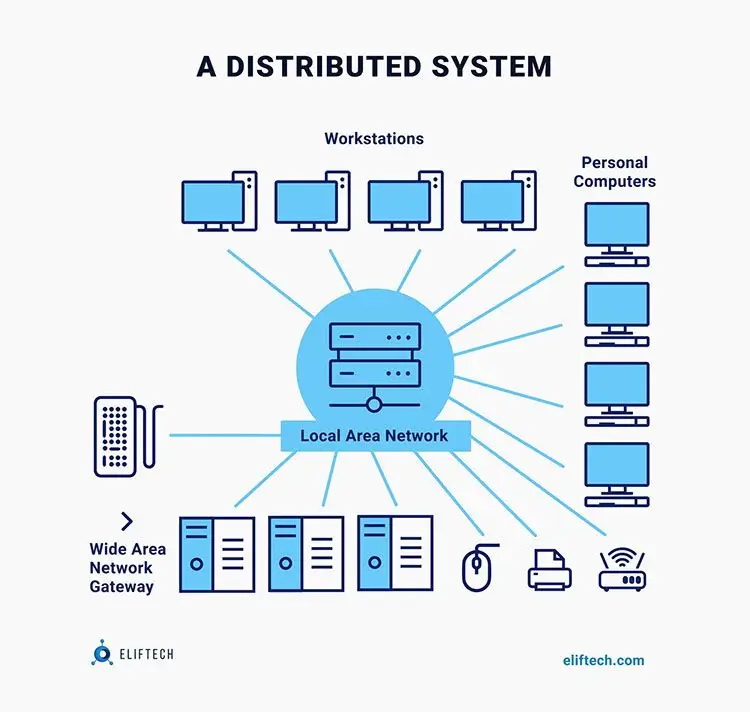

Distributed architecture refers to an architecture design approach in which a system consists of several interconnected components, often located on different computers or servers. There is no requirement for the location of such computers:

- they can be placed physically close to each other and connected by a local network;

- they can be placed in the distance and connected by a wide area network.

The distributed architecture uses separate nodes to communicate and sync to a shared network. Such nodes usually represent individual physical hardware devices, but under different circumstances, and in some cases, they can represent other recursive encapsulated systems as well.

This architecture's components work together to achieve a common goal, such as processing data (using different levels of openness to the software), handling user requests, or providing services.

Distributed architecture is a broad term that encompasses various types of architectures used for building payment systems. Each of these types offers unique benefits and features, catering to different use cases and requirements in the payments industry. Some commonly used types include:

- Peer-to-Peer (P2P) Architecture: Participants can communicate directly with one another in a P2P architecture without the use of middlemen. Decentralized payment transactions are made possible by the fact that each participant acts as both a client and a server.

- Client-server architecture: In a client-server architecture, payment systems consist of multiple client devices (e.g., smartphones, web applications) that communicate with a centralized server. The server manages data storage, transaction processing, and other payment-related operations.

- Blockchain-based architecture: Blockchain-based architecture, such as in cryptocurrencies like Bitcoin, utilizes a decentralized network of computers called nodes to validate and record transactions. Transactions are organized into blocks and connected in a chain, which ensures transparency, security, and immutability.

- Distributed Ledger Technology (DLT) architecture: DLT architecture, like blockchain, relies on a distributed ledger to track and verify payment transactions. It enables numerous nodes to take part in the consensus procedure and maintain a synchronized shared ledger.

For more clarity, the illustration below depicts the complex structure of distributed system architecture.

In order to understand this system more thoroughly and explore its potential benefits for payment systems and payment gateways, let us examine the key characteristics of distributed architecture:

- Resource sharing – the resources such as hardware, software, or data that can be directly or remotely accessed across multiple computer systems.

- Simultaneous processing – many computers can process the same function simultaneously, which simplifies many processes.

- The openness of the extensions and improvements of distributed systems.

- Transparency simply means that the node can communicate with other nodes in the system. There are many types of things referred to as transparency: replication, access, location, concurrency, etc.

- Fault tolerance – it is essential to understand that any system can fail, but the goal should always be to build it so that the system is always available even after something has failed. This is achieved by distributing the workload across multiple components and using redundancy techniques.

- Error detection – many failures can be easily detected and prevented.

- Concurrency – multiple activities are executed at the same time. It allows for a reduction in latency and increases the throughput of the distributed system.

- Scalability – the distributed system handles the growth as the number of users or data for the system increases without compromising performance. Usually, the system is scaled by adding more computers to the network so that components do not need to be changed during this process.

- High availability – Distributed architecture ensures high availability by replicating data and services across multiple components. Users can still access the system through other available components if one component becomes inaccessible or fails.

- Decentralization – Control and decision-making are often decentralized in a distributed architecture. Decision-making is distributed across multiple components rather than relying on a single central server or component, improving reliability and resiliency.

Differences Between Distributed Architecture and Traditional Centralized Systems

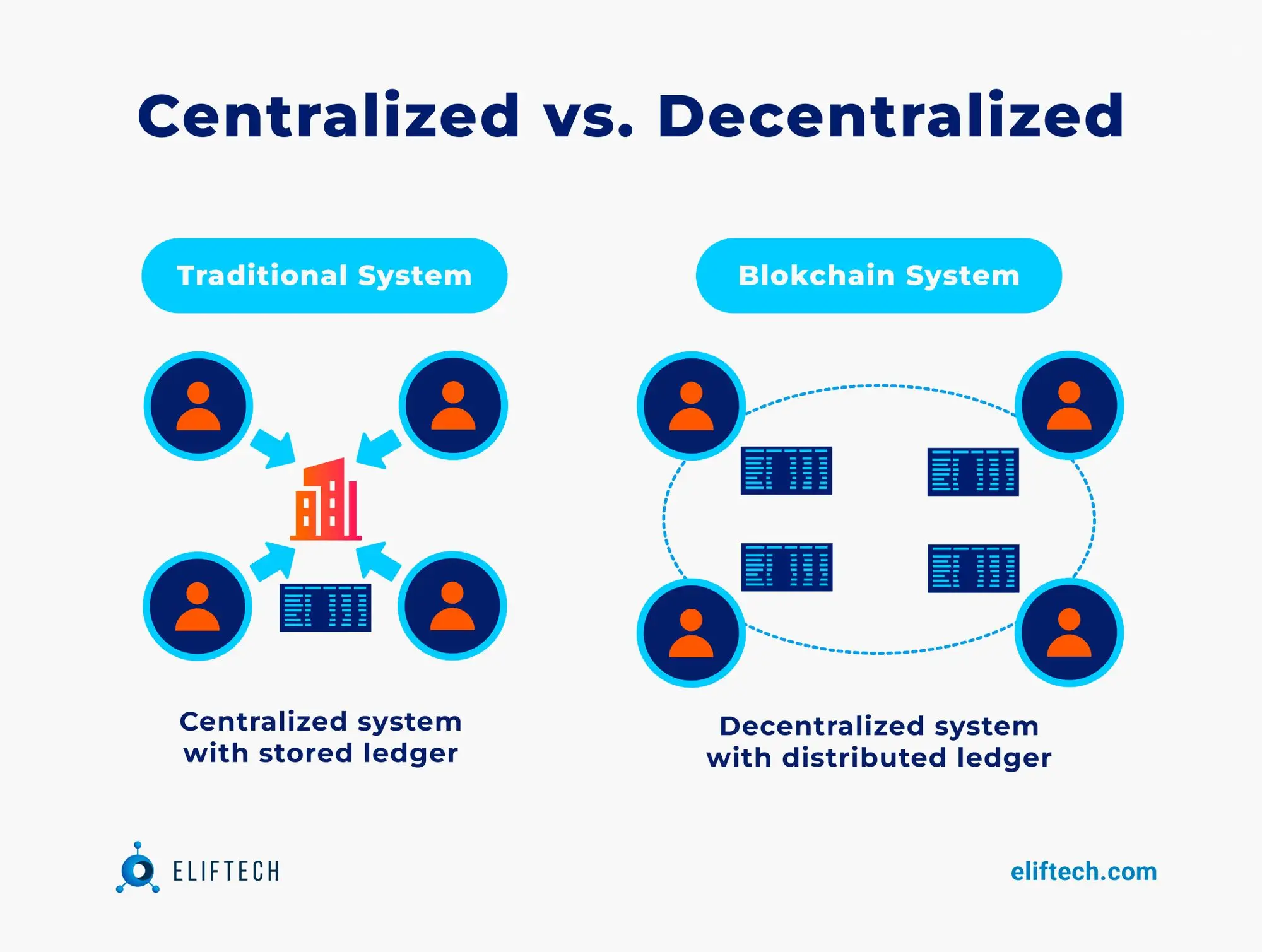

If we take a closer look at the image provided, we can see that a distributed architecture operates differently from traditional centralized systems. Let us highlight the core differences between them.

- Single-point-of-failure vulnerabilities. The entire system will stop working in a traditional centralized system if the main server fails. Since there are redundant components in a distributed architecture, the failure of one component does not lead to the failure of the entire system.

- Scalability. Traditional centralized systems often fall short when handling increased transaction volumes and accommodating growing user bases. Distributed architecture, on the other hand, allows for easy scalability by adding more components to share the workload.

- Data localization. In traditional centralized systems, data is usually stored in one place, which leads to potential bottlenecks and performance issues. In a distributed architecture, data can be shared across multiple components, allowing faster and more efficient access.

- Control and authority. In a distributed architecture, control and authority are decentralized. Decisions are often made by consensus between nodes because no single organization has complete control over the system. Decentralized decision-making and a modular structure make implementing new features easy, integrating with external systems, and adapting to changing requirements. On the other hand, centralized systems have a central authority that manages the entire system and makes decisions on behalf of the users. Due to such dependence on a single authority, it may face limitations in terms of flexibility.

Distributed payment systems and Distributed Ledger Technology (DLT)

One of the fundamental technologies that power distributed payment systems is Distributed Ledger Technology (DLT). Distributed payment systems such as cryptocurrencies use DLT to enable secure and decentralized transactions without the need for intermediaries such as banks.

Blockchain, a type of DLT, is commonly used to record and verify transactions across multiple distributed nodes. By leveraging DLT, distributed payment systems ensure transparency, immutability, and security in financial transactions. Each transaction is recorded on the distributed ledger, and all participants have access to the same copy of the ledger. Thus, there is no longer a need for a central authority to verify and authorize transactions.

Distributed payment systems based on DLT technology are able to overcome the limitations of traditional centralized payment systems, such as high transaction fees, slow processing times, and the risk of fraud or manipulation. Instead, transactions can be processed quickly, securely, and at a lower cost, making them ideal for a variety of applications such as cross-border payments, smart contracts, and peer-to-peer transactions.

Moreover, the future of global payments is bound to move in this direction. According to Deloitte, in the future, global payments will be incorruptible, liquid, prompt, economical, and visible through the use of new technology such as DLT and smart contracts. This will improve security and efficiency while reducing costs and providing better visibility for regulators.

Examples of Successful Implementations

There have been several instances of distributed architecture being effectively employed in payment systems, leading to significant advancements. Two prominent examples, Uber and Airbnb, showcase how these companies have leveraged this approach to enhance scalability, reliability, security, and expand their global presence.

Uber

Online businesses rely heavily on payment systems for their operations. One notable example is Uber, a well-known ride-sharing platform. Uber has effectively implemented a payment system based on a distributed architecture. This approach, supported by advanced technologies such as blockchain, has enabled Uber to reap numerous advantages in their payment system design.

Benefits achieved:

- High scalability. The distributed architecture has enabled the company to handle enormous transactions without any performance issues. According to Uber's website, they facilitate over 23 million trips per day, which translates to billions of transactions annually.

- Seamless payment processing. Uber's payment system prioritizes and routes payments to individual drivers so they receive payments quickly and seamlessly.

- Enhanced security. Distributed systems allow Uber to encrypt and distribute payment data across multiple nodes, thereby improving security and reducing the chance of being hacked.

Lessons learned:

- Ensure smooth integration with other components of the system. According to Uber, the payment process is incorporated into the trip request and completion flow. A distributed architecture concept helped them to provide users with an effortless experience.

- Regularly monitor and optimize system performance. Uber's website mentions their proactive monitoring and optimization practices to ensure their payment system's reliability and efficiency, which indicates the distributed system handles this task efficiently.

- Navigate and comply with various regulatory frameworks in different regions. Uber operates across 72 countries, requiring compliance with a wide range of regulatory requirements. In simple terms, a distributed system has made this easily possible.

Airbnb

As one of the leading online marketplaces for accommodations and rentals, Airbnb manages a large volume of transactional data, necessitating a robust payment system architecture that guarantees seamless and secure payment processing. To this end, Airbnb has adopted a distributed architecture approach, an innovative design that leverages advanced technologies like blockchain to create a more efficient and secure payment system.

Through this distributed architecture approach, Airbnb has gained numerous benefits, including:

Benefits achieved:

- Global scalability. The distributed architecture enables Airbnb to process payments from users around the world, accommodating different currencies and payment methods.

- Lower transaction costs. By introducing a distributed payment system, Airbnb has managed to lower transaction costs connected with payment processing. Airbnb's transaction fees for online booking range from 5% to 15%, depending on the country.

- Significant savings. With over 800 million bookings since launch and an average booking per night of $55, Airbnb has saved a significant portion of its revenue by implementing a distributed system.

- Customization for regional requirements. Airbnb's payment system design is flexible and allows customization as per the requirement of a specific region or country.

Lessons learned:

- Ensuring scalability and flexibility. Airbnb has successfully scaled its distributed payment system globally. Airbnb operates in over 220 countries and regions, demonstrating the flexibility of its payment system to accommodate regional requirements.

- Adapting to regulatory requirements. Airbnb understands the importance of navigating and complying with various regulatory frameworks around the world. Aribnb’s worldwide reach speaks for itself.

- Ensuring seamless user experience. Maintaining a smooth and consistent user experience throughout the payment process is essential for customer satisfaction and retention. Airbnb's payment process based on distributed architecture is designed to be user-friendly and seamless, providing a positive booking experience.

Benefits of Distributed Payment Systems

A centralized payment system requires a lot of resources and equipment, making it very expensive. On the other hand, decentralized systems do not require much investment as they are cheaper to operate and maintain. This is because they don’t need as much hardware as centralized systems do. Centralized systems also are vulnerable to cyber attacks because all transactions are performed through one server or computer which makes them easy targets for hackers and criminals who want to steal information or money from you or your clients. In fact, there are many advantages to using a decentralized system over a centralized one, here are some of them:

Reliability

Reliability is a crucial factor in payment gateway architecture, especially when handling sensitive user data. Distributed payment systems are specifically designed to prioritize resilience, offering a high level of reliability. These systems excel in terms of dependability due to their built-in data replication and backup practices.

If you want to know more about implementing security features in your payment gateway, we would highly recommend you read the article "How To Develop A Payment Gateway: Your Hands-On Guide"

Processing large data volumes

Many payment services, such as PayPal, have more than 430 million active users, and it can be hard to find a good combination of software and hardware that works best for the payment gateway. This is where leveraging distributed systems can make a significant difference, providing efficient load balancing, addressing the challenges of handling large data volumes, and ensuring reliable payment processing architecture at scale.

Scalability

As we discussed earlier, one of the main characteristics of distributed computing systems is the ability to be flexible to changes and to add more nodes (servers) to the network when needed. This way, businesses can handle increasing transaction volumes without compromising performance. As businesses grow and attract more customers, a distributed system architecture can easily handle the increased workload.

Low latency

Many factors affect the performance of your payment gateway architecture. For example, the location of your services: the payments made in Europe shouldn't be processed in the US. Here you will need access to the database to understand how long the system will respond.

Low latency enables faster transaction processing times, reducing the waiting period for customers during online payments. It also enhances the efficiency and responsiveness of online payment transactions, leading to improved user satisfaction and overall efficiency of payment services.

Also, if you want to read more about the impact of location on the payment gateway, the article "Payment services: Regional Limitations" can be helpful.

Capacity

Distributed database systems will allow you to understand the expected load the system can support in just a few seconds. These rapid insights into the system's anticipated workload capacity enable efficient capacity planning and swift decision-making for scaling the system accordingly.

Distributed database systems provide valuable insights into the capacity of a system to handle workload efficiently. With the ability to assess the expected load in just a few seconds, these systems facilitate efficient capacity planning and enable quick decision-making for scaling the system as needed.

Transaction speed

Thanks to the use of decentralized networks and parallel processing capabilities, distributed payment systems can process transactions significantly faster than traditional payment systems. Distributed systems can greatly reduce the time it takes to validate and complete transactions by using multiple nodes or computers at the same time. This means companies can confirm transactions quickly, making customers happier and less likely to cancel transactions.

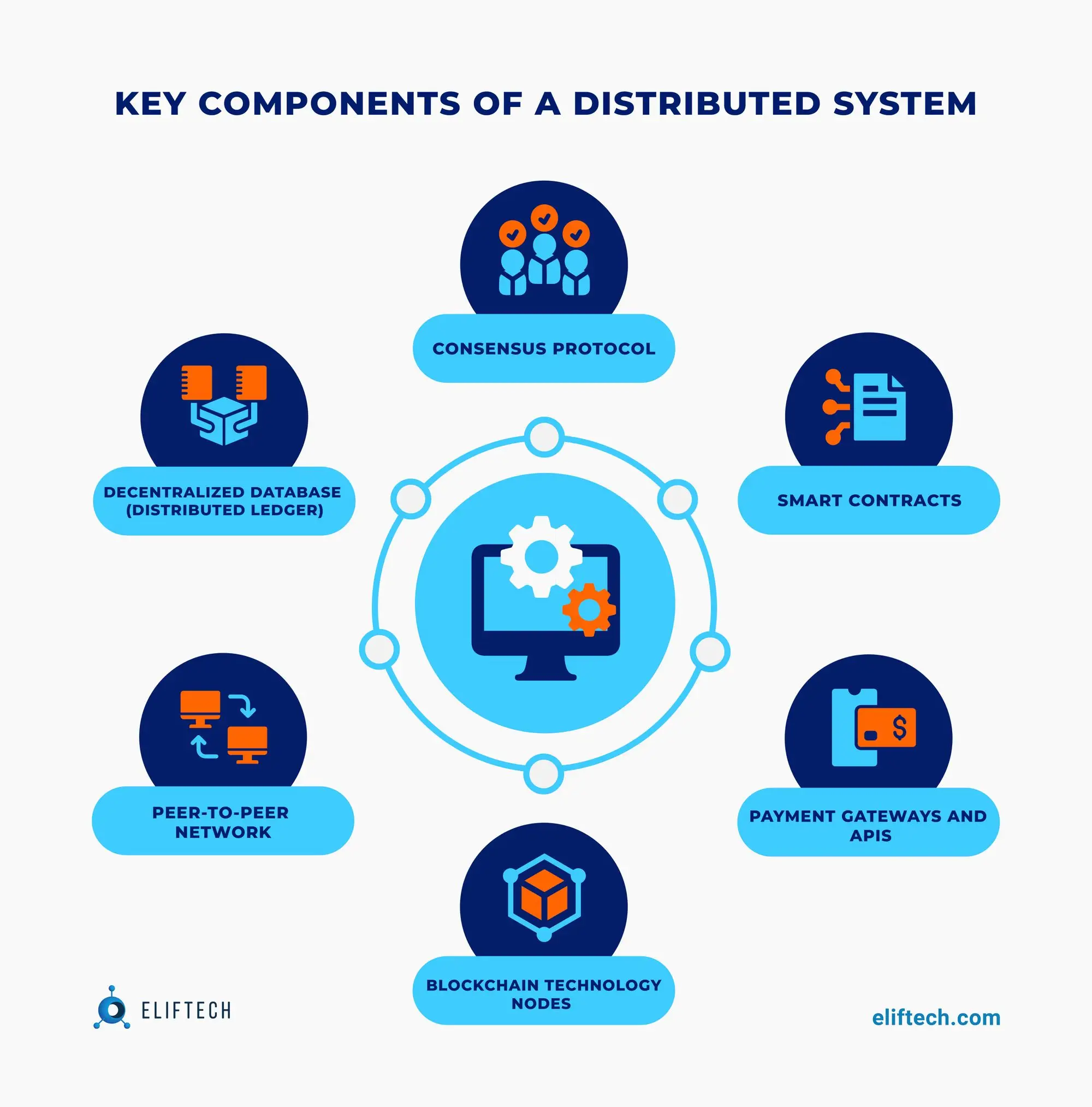

Key Components of Distributed Payment Systems

Despite the attractiveness of the tenet of decentralized payment systems and the seemingly endless possibilities they present, it is important to know the reasons behind their steady growth — right from their inception. And also understanding all the vital components that make up these systems so that you can realize why they are better than centralized ones.

Blockchain technology

Blockchain technology plays a crucial role in the architecture of payment systems by providing a decentralized and tamper-proof ledger. It records transactions in blocks and links them together in a chain, creating an immutable record of all payment transactions. This transparency and immutability enhance security and trust by preventing unauthorized changes to transaction data.

Role of blockchain technology: Blockchain secures transactions and ensures that they cannot be changed or reversed. The decentralized nature of blockchain also makes it highly resilient to attacks and failures, ensuring the continuous availability of payment systems.

According to Worldwide Asset Management insights, using blockchain technology for payment systems provides a new degree of trust and reliability in the digital economy. It’s like “a protocol for money on the internet, and anyone that connects to it can exchange value in the same way we exchange an email, a photo, or any other data.” With distributed ledgers, any commerce or financial product, or digital wallet, can be transacted and settled directly with any counterparty online while also increasing speed and reducing cost by eliminating middlemen.

Nodes

In a distributed payment system architecture, nodes act as the individual components that make up the network. Personal computers, servers, and mobile devices are some examples of nodes. Each node is responsible for processing, verifying, and recording transactions in a shared ledger.

Peer-to-peer network

In a distributed payment system architecture, a peer-to-peer network allows a direct exchange of information and transactions between nodes. Examples of peer-to-peer networks used in distributed payment systems include the Gnutella protocol used in BitTorrent and the Bitmessage network.

Decentralized database (distributed ledger)

A distributed ledger is a decentralized database containing all transaction records in a payment system based on a distributed system architecture. The ledger is stored on all the nodes in the network, ensuring that all participants have access to the same information. Blockchains Bitcoin, Ethereum, and Ripple's Interledger protocol are examples of distributed ledgers used in distributed architecture payment systems.

Role of decentralized databases: Decentralized databases powered by blockchain technology distribute data across multiple nodes, reducing the risk of downtime, hacking, and fraud. This enhances system resilience, making payment systems more reliable. These databases also enable high scalability, as multiple nodes can process transactions concurrently. As a result, payment processing remains quick and efficient, even during high transaction volumes.

Consensus protocol

A consensus protocol is a mechanism that ensures that all nodes in the network are in agreement about the validity and order of transactions. This helps prevent double-spending and ensures that the ledger is accurate. Consensus mechanisms, such as Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS), enable secure and reliable transactions in payment systems. They offer different levels of security and efficiency based on the system's needs.

Role of consensus protocols: Consensus protocols play a crucial role in enhancing security by providing resilience against attacks, specifically the 51% attack, where an attacker gains control of the majority of nodes in a network. Consensus protocols allow distributed payment systems to be decentralized, transparent, and secure.

Smart contracts

Smart contracts are like computer programs that run automatically when certain conditions are met on blockchain platforms like Ethereum. In the context of payment systems, they enable the automation of payments once predetermined criteria are satisfied. This facilitates secure and reliable agreements between parties involved in the transaction.

Smart contracts play a crucial role in resolving disputes by automating the process based on predefined rules. They reduce transaction friction and associated financial or legal costs by eliminating the need for intermediaries. Smart contracts in distributed payment systems also provide increased security, eliminating fraud and errors. They are transparent, immutable, and self-executing, which means that they are free from human errors, omissions, and interference. In addition, they promote transparency, meaning that all parties involved in a transaction can witness each step of the payment process, reducing potential cases of fraud or errors.

Payment gateways and APIs

Payment gateways and APIs play a critical role in ensuring interoperability between different payment systems or networks. They serve as standardized protocols and interfaces, enabling seamless communication between these systems. In other words, interoperability ensures that different payment systems or networks can communicate and transact with each other seamlessly.

The role of interoperability and integration: Seamless integration with existing systems allows for a smooth transition and minimizes disruption to established payment networks. Interoperability ensures that different payment platforms can communicate and transact with each other, fostering a cohesive and connected financial ecosystem.

Best Practices for Building Distributed Payment Systems

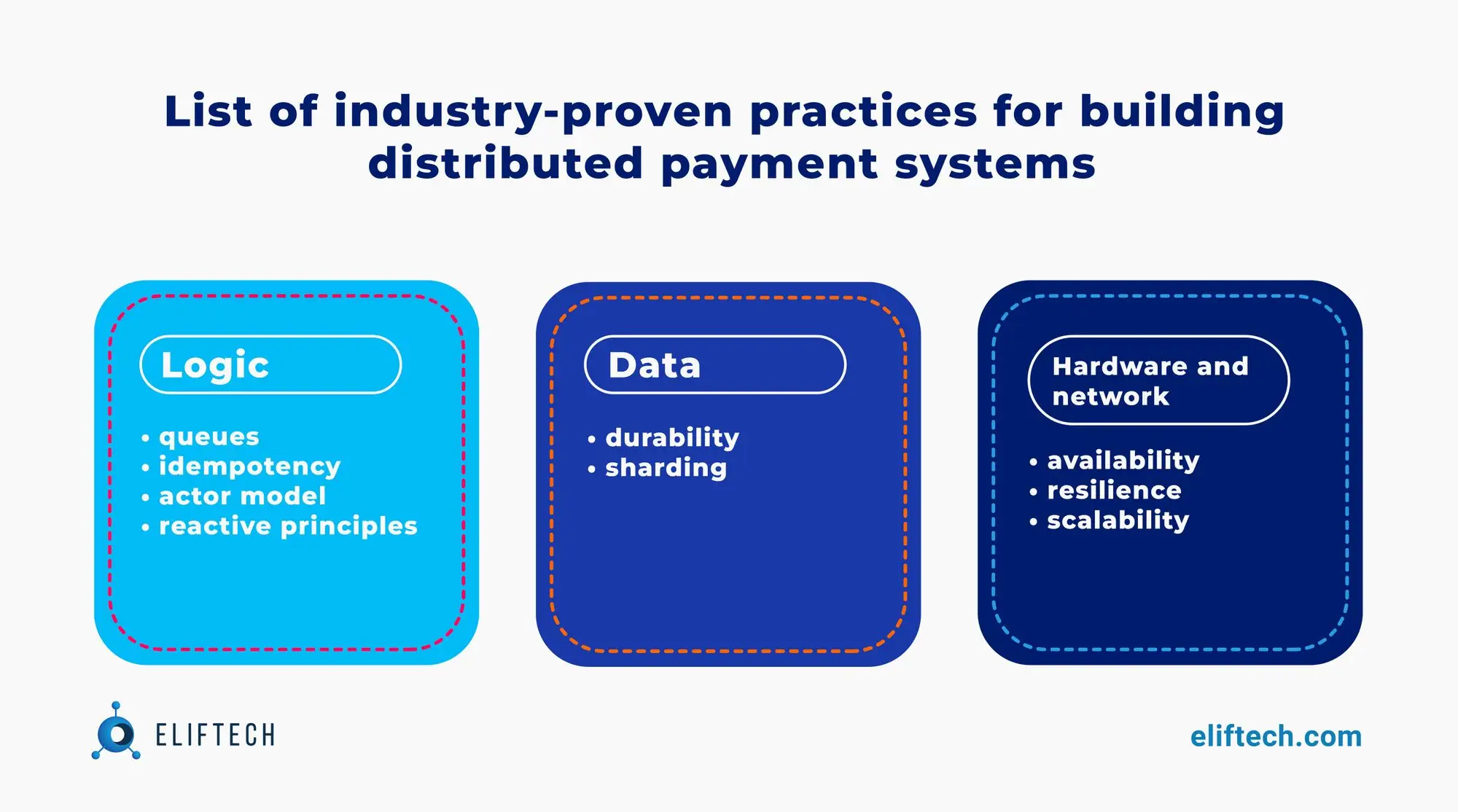

Building a distributed payment system architecture requires setting unique requirements for each project. It is not the “one-size-fits-all” case. So, we would like to share with you a list of best practices for building a distributed payment platform architecture in terms of logic, data, hardware and network.

Logic

Practice 1. Use message queues for asynchronous processing

Action required: Implement message queues to decouple components and handle payment requests asynchronously.

What is it for: Asynchronous processing using message queues allows for better scalability and performance. It enables the system to efficiently handle a large number of payment requests without blocking operations, resulting in improved responsiveness and increased processing capacity.

Practice 2. Ensure idempotency in payment processing

Action required: Implement idempotency checks to ensure that performing the same payment operation multiple times produces the same result.

What is it for: Idempotency plays a crucial role in distributed systems, especially in payment gateway architecture, as it ensures predictability and reliability. In the context of payment systems, where unpredictability is undesirable, idempotency provides an excellent solution. Designing a payment system with idempotency in mind enables the system to handle retries, network failures, and user errors without processing duplicate payments, ensuring a smooth and consistent payment experience.

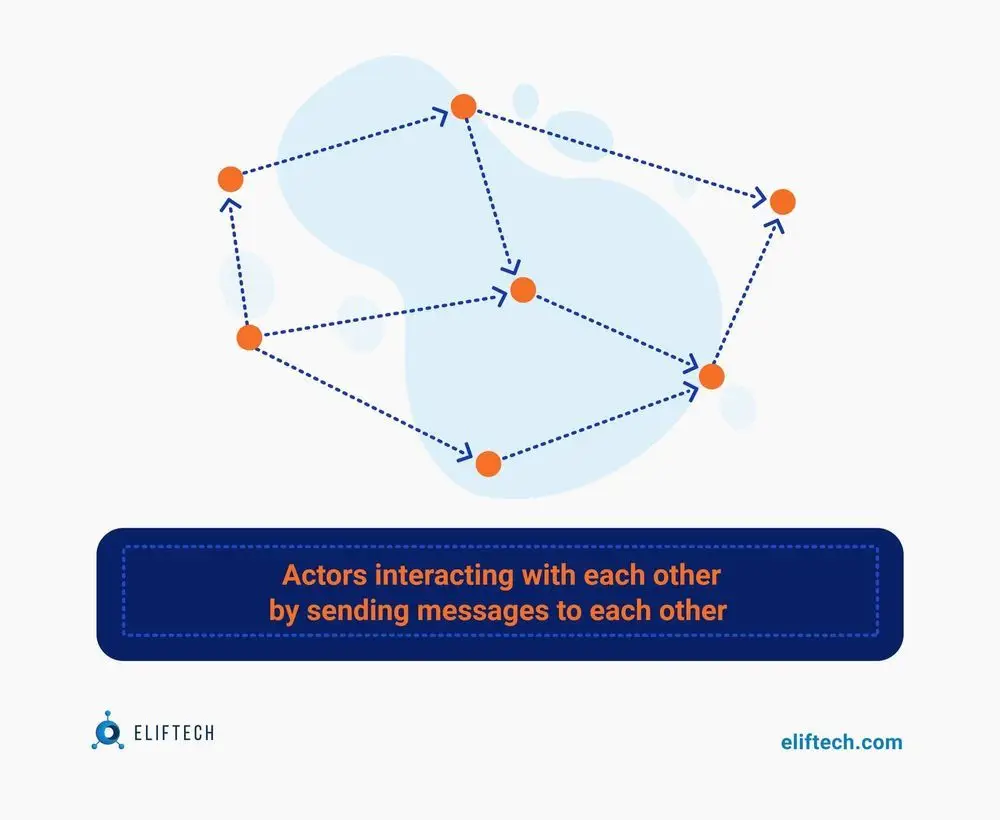

Practice 3. Incorporate the actor model

Action required: Use the principles of the actor model to build and manage distributed systems. Specifically, distribute workloads across multiple actors for scalability and high concurrency.

What is it for: The actor model is a paradigm that emphasizes message passing between separate actor entities, which have a limited set of capabilities: creating other actors, sending messages to others, and deciding how to handle incoming messages. Despite these simple capabilities, the actor model provides a powerful tool for designing complex and distributed systems like payment gateways that can even repair themselves if one of the actors fails.

Practice 4. Follow reactive principles

Action required: Use asynchronous message-passing to decouple components, produce resilient systems, and prioritize responsiveness via message-driven architectures.

What is it for: Reactive principles are designed for efficient, responsive systems and aim at building distributed systems that respond in near real-time to high loads and are highly fault tolerant. In other words, reactive principles support the development of highly scalable, efficient, and reliable distributed systems that meet the demands of modern payment systems.

Data

Practice 1. Implement excellent data management practices

Action required: Ensure data durability and sharding

What is it for: Durability means that when any data is added to a system datastore, it will be available going forward. An important moment here: even if nodes in the system will run offline or the crash occurs, such a process does not stop. Sharding – a complicated algorithm that helps manage distributed databases. It enables you to ensure proper load distribution: your data is split into small segments located on multiple devices.

Hardware and network

Practice 1. Design for fault tolerance and high availability

Action required: Implement redundancy and replication techniques to ensure that individual node failures do not disrupt the entire system.

What is it for: By designing for fault tolerance and high availability, the system can continue to operate smoothly even if certain nodes fail. Redundancy and replication help distribute the workload and ensure uninterrupted payment processing architecture. However, remember that you can not expect 100% availability from your system here. Even top services like Amazon typically offer 99,99% of it.

Practice 2. Implement robust security measures

Action required: Securely handle payment data using encryption, secure communication protocols, and access controls.

What is it for: Security is critical in payment systems. Protecting sensitive data, such as card details, is paramount. Implementing security practices helps prevent unauthorized access and maintain data integrity.

Practice 3. Plan for scalability

Action required: Design the system to handle increasing transaction volumes and scale horizontally.

What is it for: When a business implements a newly built system, it will likely grow, and the load will increase. At some point, the existing setup may struggle to handle the added load, requiring additional capacity.

There are two common strategies for scaling the system: vertical scaling and horizontal scaling. We suggest scaling your system horizontally. It allows for easy and quick scalability by adding more (virtual) machines to an existing cluster to distribute the load and boost capacity. In the case of vertical scaling, you will need to upgrade the hardware or configuration of the existing machines, which can be more resource-intensive and costly.

Conclusion

Building distributed system architecture can offer numerous benefits to your unique business only if implemented correctly, and you know exactly what you need. In this regard, we understand the above practices and key components are general, and each payment system design is unique and requires customized development.

With our experience in distributed architecture development in place and skilled professionals who are familiar with the intricacies of distributed architectures, we know how to leverage distributed ledger technologies, blockchain concepts, and decentralized systems to create robust and reliable distributed payment systems that fit your needs.

If you want to build a perfect distributed payment system or need expert guidance, do not hesitate to contact our dedicated team!

Browse our case studies and get actionable insights to drive your success

See more