FinTech

Step-by-Step Guide for Feature-Rich Digital Wallet App Development

With the advancement of technology and the increasing use of smartphones, digital wallets have become more popular than ever. In the past few years, eWallets have become the fastest-growing segment of payments.

The Research and Markets state that by 2025 the volume of non-cash transactions in the global market is forecasted to surpass the 1.5 trillion mark

According to a report by Juniper Research, there will be more than 5 billion digital wallets by 2022. While this is a huge number, it doesn’t even account for all of the mobile wallets. This report claims that digital wallets will grow at a CAGR of 16% between 2020 and 2026.

It’s easy to see why mobile wallets are so popular: they offer a convenient payment process that works on any device and lets users buy any product or service from their smartphones in a few clicks. Additionally, mobile wallets have fewer fraud risks because they secure user payment information by adding biometric authentication features like face ID, Touch ID, etc., setting strong passwords, and multi-factor authentication.

How do digital wallet apps work?

A digital wallet is a software application that allows users to store electronic money, debit and credit cards, loyalty cards, gift cards, membership cards, etc. Basically, e-wallets are equivalent to regular ones, but they are safer and help simplify many processes.

In our previous article, we explained more about the importance of digital wallets, their types, and things you need to consider while creating ones.

So, how do those apps work? Usually, people use them for contactless payments, but as we mentioned above, users can store their gift cards, loyalty cards, and many other things. Let’s concentrate on payment here.

Different digital wallets use various technologies to complete transactions:

- QR codes – These are machine-readable barcodes that can contain information about the item to which it is attached. Users can scan the QR with the smartphone’s camera and pay. For example, with a PayPal app, you can generate a QR code that enables your account to pay for an item in a store.

- NFC (Near Field Communication) – This technology connects the two NFC-enabled devices to transmit payment information if they are close to each other. For instance, Apple Pay and Google Pay use NFC for transactions. It’s important to mention that to enable NFC mobile payments, merchants must have the right equipment. But all the modern payment terminals include embedded NFC technology and chip readers, so equipment is not a problem.

- MST (Magnetic Secure Transmission) – It generates a magnetic signal similar to that of a traditional payment card when swiped, providing the added convenience of being able to pay quickly on the go without reaching for your wallet. This technology is used for Samsung Pay.

- UPI (Unified Payment Interface) – This real-time payment system allows one to complete peer-to-peer inter-bank transactions through a single two-click factor authentication process. It eliminates the need to enter sensitive data (like CVV code, PIN, etc.) each time a customer initiates a transaction. UPI technology is used in Google Pay, Amazon Pay, and many other apps.

The aforementioned examples can be used with the right equipment at any store or merchant. It's called an open e-wallet. Also, there are closed digital wallets that are made to be used at specific stores only. A great example of this is the Starbucks app. You can read our article “How to make a digital wallet app?” to learn more about the types of wallets.

Guide to digital wallet app development

As with any other complex system, digital wallets should be developed in 2 stages: Discovery and Development Phases. Here we want to pay attention to some crucial moments of the digital wallet app development process.

Discovery Stage

During this phase, you will clarify the goals and values of your project and get to know your users. This phase is challenging because you need to predict many moments and identify the risks. Here are key elements to keep in mind at this stage:

- Regulatory Compliance: Digital wallet platforms should comply with general and local banking legislation. Also, online financial services' popularity has led to the development of cyber-criminal methodologies that use those services to launder money or finance terrorist activities. To minimize such risks, various financial institutions and systems worldwide are required to create Anti-Money Laundering (AML) Compliance Programs.

- User Data Security: While consumers use your application, you will process their personal data, including sensitive financial information. To provide security to your clients, we recommend using two-factor authentication like the 3-D Secure system, which Visa and Mastercard developed. Also, e-wallets should have a layer of advanced encryption with a random number generation for each transaction. In such a case, hackers will not be able to intercept the customer's transaction because they won't be able to use the data they had.

- Fraud Risks: Any industry has its type of vulnerability, and when it comes to the financial field– it’s the risk of fraud. There are many ways to minimize it:

- Be on the lookout for suspicious behavior

- Secure the payment pages of your website

- Use smart decision software to seek out fraudulent activity

- Separate the technology used for your company’s financial activities

Conduct Market Research. Why is it important?

To successfully manage a business, it’s crucial to conduct proper market research. The more informed you are of customer expectations and needs, the better you will be at building a relationship with those clients. Without market research surveys, it would be nearly impossible. By creating and analyzing effective research, companies can obtain key insights about the target audience, such as what products will be popular, what features the app must have, and how many people are willing to use them.

Basically, market research helps to understand consumer needs and requirements before launching new products on the market. This process predicts how the application will perform in the real world. By gathering data from the perspective of consumers and competitors, research will provide you with general feedback on the current marketplace.

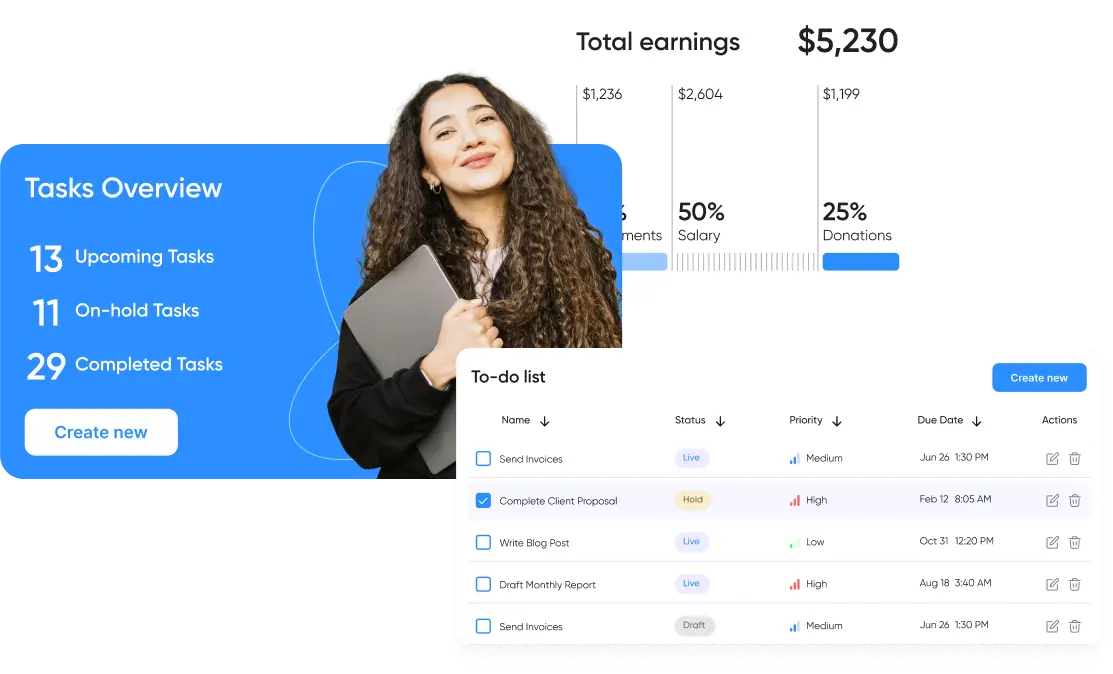

Custom UI/UX Design

Professional UI/UX is crucially important for the overall application performance. Ralf Speth once said: “If you think good design is expensive, you should look at the cost of bad design.” And we definitely agree with him because the app's design is not only about a beautiful interface but also about your product’s usability. To meet your client's requirements and to fit in the modern market, you need to have a custom UI/UX Design.

User Experience design is the personal experience customers feel when interacting with your product. Usually, the UX process has five key phases:

- Product definition

- Research

- Analysis

- Design

- Validation

During those processes, designers do individual in-depth interviews, competitive research and analysis, and create wireframes and prototypes. The key to good UX design is understanding your clients and being user-centered when it comes to the design.

User Interface design is a visual implementation of UX design. UI designers focus on making the interaction between user and product enjoyable, efficient and easy.

During this stage, designers will create sketches, wireframes, components design, user flows, and prototypes.

Features to include during the Development Phase

During the development phase, you will need to implement basic features in your digital wallet application. In our article “E-Wallet app development - key features and cost,” we discuss the features in detail.

- User Authentication & authorization

- Creation and management of profile

- Synchronization of payment cards

- e-Receipts

- GPS Tracking

- Push Notification

Of course, to make your app competitive and distinguishable on the market, you need to customize the features of your app and create additional ones.

App Testing and Launching

When your e-wallet app is ready to be released on the platforms, our team will launch the application on the platform of your choice and create an account with the relevant app title, screenshots, informative descriptions, and keywords.

The demands and needs of users are growing every year. To ensure that your app meets modern standards and is competitive in the market, our team will provide you with support and maintenance process, which includes:

- App enhancement

- Feature extension

- Analytics & Monitoring

- App upgrade

Digital wallet application development technology stack

During the application development process, our professionals will use this stack of technology:

- For Mobile Development: Flutter, ReactNative for cross-platform applications; Kotlin and Swift for native mobile applications;

- For Web Development: (if you want a web version of your app or “hybrid” version - Progressive Web Application):

- For modern & fluent UI/UX frontend: Vue.JS, React.JS, TypeScript, HTML5

- For fast and robust backend: Golang, Node.js

- For Backend Development: Node.JS, Angular.JS, Java, Ruby, Python, PHP, Django, MongoDB;

- For Database: MongoDB, DynamoDB, Postgres/MySQL, Redis, ElasticSearch.

- For QR Code Scanning: ByteScout BarCode, ZBar Code Reader, etc.

- For Analytics: Amazon Kinesis, Apache Kafka, etc.

- Cloud Services: Amazon Web Services, Google Cloud, Azure, etc.

- To enable Push Notifications: Amazon SNS, Firebase Cloud Messaging, etc.

- For Geolocation: Google Maps API

- Payment Gateways: PayPal, Stripe, QuickPay, etc.

Team composition for developing a digital wallet application

To bring your idea to life, the whole team of specialists will work on your application. Typically, the team composition consists of the following:

- A Project Manager is a person responsible for managing the whole development process to help organizations achieve their goals. They plan, execute, and delegate responsibilities so that projects are completed in a reasonable time period.

- A Business Analyst analyzes data and requirements to deliver data-driven recommendations and reports to stakeholders and executives. The role of a business analyst is to ensure that all business processes are properly defined, documented, and implemented.

- A UX/UI designer is responsible for providing the design of your app based on research, usability tests, and interviews with users.

- A Mobile Developer is a software developer specializing in building applications for mobile devices and specific operating systems.

- AWS Certified DevOps engineer uses CI/CD methodologies to create and implement software systems

- A Front-end developer (if you want to make a website) builds the part of the website that users actually see and interact with.

- A Back-end developer writes code that forms the backbone of websites and apps. They build and maintain the mechanisms that process data and perform website actions. Their work is often invisible to users, but it's critical for a digital wallet application to function correctly and minimize the risk of data leaks.

- A Quality Assurance engineer’s job is to find and fix bugs in a product before it goes live. This process is necessary for e-wallets because it prevents bugs and security issues from happening.

Interested in developing a digital wallet app?

If you are interested in building your own digital wallet application, do not hesitate to contact us.

ElifTech has excellent experience in building e-wallet applications. Recently, our company helped Class Wallet make a payment solution for educational organizations, eliminating paperwork and manual processes, reducing transaction costs, and enabling real-time monitoring of transactions. The platform we built has quickly gained popularity and is in demand among its users, with a customer renewal rate of 98,9%.

Our team makes it possible for each product we developed to launch the app successfully and overcome competitors on the market by customization of your app by implementing the latest features and technology. At Eliftech, our experts put forward a professional approach and consistently work to ensure the quality of our services. Team up with us today so that we can bring your idea to life!

Browse our case studies and get actionable insights to drive your success

See more