Wealth Management

Wealth Management Data: Benefits of Market Data Integration and Analytics

The blend of finance and technology has revolutionized fintech wealth management, providing efficient solutions to the challenges faced by today’s business leaders. Key discussions in global industry conferences revolve around the complex nature of data integration, investment risks, security and compliance concerns, and legacy system integrations. These challenges emphasize the need for effective wealth management technology solutions.

One such solution is using big data and advanced wealth management analytics. Their business value comes from optimizing real-time financial information, personalizing customer experiences, optimizing investment strategies, and more.

In this blog post, we aim to explore data integration’s key role and future potential in wealth management. Uncovering its benefits and challenges will help you understand how wealth management data integration can drive your financial operations and how to get more value from this data. Plus, we provide expert advice and industry insights to guide you toward successfully implementing wealth management technology solutions.

Wealth Management Data: Benefits and Challenges of Market Data Integration

Much of today’s generated data is stored and managed in legacy systems. The proliferation of different data types and changing financial regulations in recent years has made the situation even worse. All these problems forced many organizations to struggle with data silos. These data silos not only pose risks and inefficiencies but also put businesses at a competitive disadvantage.

To address these challenges, integrating data has become essential. A recent study by Deloitte research found that 86% of respondents have increased their spending on data and analytics in the past three years. This indicates a growing recognition of the value and demand for data integration in wealth management.

So, reality shows us the role of data integration in wealth management goes beyond mere expectations. In the context of wealth management, data integration serves as the foundation for informed decision-making and personalized client services. It involves gathering data from different platforms, such as banking systems, investment platforms, and client relationship management tools. In this way, wealth management firms can gain a holistic view of client's financial information to identify and monitor multiple patterns and correlations.

By gathering, analyzing, and organizing data, wealth management firms can automate tasks, reduce errors, improve efficiency, and provide a better overall experience for their clients. This approach allows wealth managers to better understand their clients' financial situations, manage risks more effectively, offer personalized solutions, streamline operational processes, and ensure compliance with regulations.

Sources of Wealth Management Data

In wealth management, access to accurate and timely market data is paramount. Market data offers insightful analytics that helps investors make wise choices. With the rise of wealth management technology solutions, several market data sources are available to assist investors in their investment strategies. We will categorize these sources based on the data origin to better understand them.

Primary Sources

Primary sources are those that provide original data and information. Financial exchanges and data providers fall into this category as they are responsible for generating financial data.

- Financial exchanges. Stock exchanges like the New York Stock Exchange (NYSE) and Nasdaq provide real-time market data for stocks and other securities. These exchanges offer data on stock prices, trading volumes, and additional relevant information.

- Data providers. Some companies specialize in providing certain types of market data. For example, Morningstar provides information on ETFs, mutual funds, and other financial products. These providers offer rich datasets on specific asset classes, industries, or regions. With this specialized data, investors can better understand certain markets and make more informed investment choices.

- Crowdsourcing and user-generated content (sometimes!). Although crowdsourcing and user-generated content are not direct market data providers, some FinTech platforms encourage users to share useful information about market trends and investing patterns relevant to wealth management.

Secondary Sources

Secondary sources are those that rely on primary sources to provide data. For example:

- Data aggregators. Platforms like Yodlee and Plaid pull data from various sources, such as banks, credit card companies, social media, news feeds, websites, and company filings, to create a consolidated dataset. By utilizing advanced analytics and algorithms, data aggregators transform raw data into a unified format, making it easier for wealth management platforms to access and analyze.

- Market data vendors. These platforms offer a wide range of real-time data, including stock prices, market indexes, news events, and other relevant market indicators. With direct access to this information, investors may track market changes, spot prospective investment opportunities, and stay informed about key events affecting their portfolios.

Specialized Platforms

These platforms are more used to understand user sentiment and to disseminate financial news and analysis. For example:

- Social media and news. Investors can obtain market data from websites like Twitter and news sources like CNBC. Users can follow financial influencers, experts, and news outlets on these networks to remain up-to-date on industry news and trends.

- Crowdsourcing and user-generated content. Such alternative market data sources offer valuable insights from individual investors' collective wisdom and experiences. For instance, eToro is a social trading and investment platform that allows users to share their portfolios and interact with other investors.

It's important to note that the availability and accuracy of market data may vary depending on the source. Various wealth management platforms may use a combination of these sources to provide their users with comprehensive and up-to-date market data.

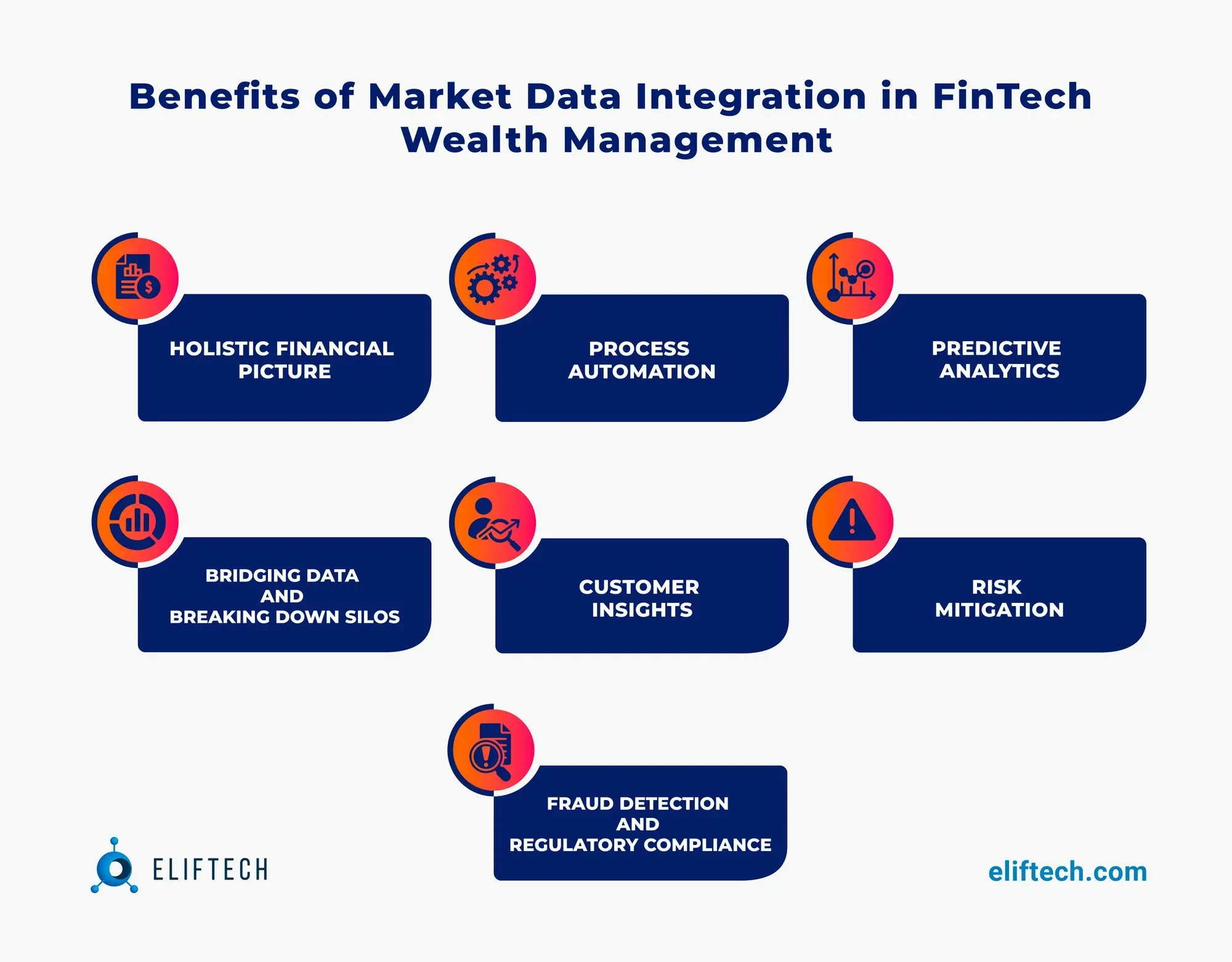

Benefits of Market Data Integration in Wealth Management Technology Solutions

Market data integration is a powerful tool that helps wealth managers build a strong and resilient portfolio, mitigate risks, and maximize returns in one place. Consolidated market databases give investors the knowledge they need to make wise choices, manage their assets well, spot emerging market trends, and avoid risky investments.

Here are the key benefits of market data integration in wealth management platforms:

- Holistic financial picture. Market data integration facilitates better analysis and provides financial firms with a wealth of valuable insights. Since the data is aggregated from various sources, such as investment and bank accounts, it provides a complete picture of assets, liabilities, and cash flows. So, the correlation is obvious - investment professionals can make more informed decisions on specific trades or portfolios rather than relying on guesswork.

- Process automation. With the rise of using NLP and similar advanced analytical methods to analyze tons of data, it became easier to enhance process efficiency, eliminate tedious manual efforts, and focus on value-added services. So, market data integration allows wealth managers to work smarter and not harder. Robotic process automation (RPA), for example, allows firms to automate different aspects of the investment process and facilitate data aggregation, including regulatory, risk assessment, reporting, trade execution, settlement, etc.

- Predictive analytics. Market data integration enables the use of advanced analytics techniques to predict future market trends, investment opportunities, and risks. By combining historical and real-time market data research, wealth managers may provide their clients with more personalized advice. In response, clients follow this advice and make proactive investment decisions rather than reacting to market events that have already occurred.

- Bridging data and breaking down silos. So much market information available can easily overwhelm wealth managers and investors. What's even worse, many financial institutions have separate legacy systems and databases that store different data types. Market data integration helps break down these silos by analyzing, consolidating, and unifying the most relevant information. This unified data integration effectively allows wealth managers to cut through the noise and access the most valuable information to improve decision-making and better understand the market.

- Customer insights. Integrated market data provides valuable insights into customer behavior, preferences, and investment patterns that organizations can use to create better customer experiences. This advantage is extremely valuable, especially for firms that still operate with multiple data silos, making it difficult to portray customer needs.

- Risk mitigation. With market data integration, FinTech companies can stay agile when it comes to shifting market trends and conditions. The real-time analysis allows wealth managers to track risks associated with market volatility, industry risks, or geopolitical events more effectively and implement strategies to mitigate them, thereby reducing negative impacts.

- Fraud detection and regulatory сompliance. Market data integration is essential to ensure compliance with laws and regulations. Organizations will be able to access the real-time data as it becomes available and identify anomalies as soon as they appear. This visibility helps identify fraudulent activities before they turn into significant problems. Additionally, wealth managers can use this data to give clients regular reports, ensuring that their investments align with industry regulations and standards, fostering trust and peace of mind.

Market Data Optimization: Challenges and Solutions

We understand our client's challenges in optimizing their wealth management data management processes. FinTech organizations require accurate, comprehensive, and timely market data to make informed decisions. However, the burden of analyzing, processing, and integrating data can be overwhelming and resource-intensive at first sight. However, ElifTEch is ready to debunk these misconceptions.

Here are some common market data optimization challenges faced by FinTech organizations, along with their solutions:

Challenge #1. Complex data integration

Wealth management firms heavily rely on market data from multiple sources and systems. To guarantee seamless data integration for analysis and decision-making, for instance, we should take into account various data formats, protocols, and APIs. Integrating these disparate data sources can be complex and time-consuming.

Solution: There are three possible solutions to mitigate this issue. You can implement a robust data management system, invest in data integration platforms, or partner with vendors that offer pre-integrated data feeds. In any case, it's important to ensure seamless data integration without overloading networks, performance issues, or data corruption, especially for organizations operating in legacy systems.

Challenge #2. Resource-intensive data processing

With such a huge amount of market data being generated, it is important to be able to analyze and filter it. However, this process can require significant resources and efforts that companies refuse to undertake. The volume and complexity of market data can overload traditional processing systems, leading to performance issues and delays in data analysis.

Solution: Some strategies used today are utilizing distributed computing frameworks like Apache Hadoop and Apache Spark, cloud computing platforms such as AWS and Azure that provide scalable resources and services for data processing, or advanced wealth management tools that allow for faster and more accurate decision-making based on up-to-the-minute market data.

Challenge #3. Poor data quality and low accuracy

Ensuring the quality and accuracy of market data is crucial for wealth management companies. According to Deloitte, wealth management firms recognize the significance of high-quality data for global expansion, sales effectiveness, and robo-investing capabilities. However, market data may occasionally contain errors, discrepancies, and delays. Resolving data discrepancies and maintaining data integrity presents a significant challenge in market data optimization.

Solution: To address this issue, wealth management firms focus on improving data accuracy by implementing data quality assessment processes and leveraging advanced data integration techniques. Moreover, firms prioritize enhancing data entry practices to reduce errors and ensure data accuracy.

Challenge #4. Lack of data security and compliance

Wealth management firms must adhere to strict data security and compliance regulations governing the collection and retention of market data. So, to ensure compliance with financial regulations, market activity must be monitored and reported.

Solution: Regular security audits, employee training, and compliance with regulations like GDPR and SEC requirements are essential to maintaining data security and compliance. Today’s wealth management firms are building strong data protection systems and implementing advanced cybersecurity tools. Other efficient measures are using cloud-based technology to implement secure data storage and backup mechanisms in case of a security breach. Or investing in automated data management tools can also help monitor and report on transactions in real time.

The Future Potential of Market Data Integration for Wealth Management Data

Market data integration is a vital component of wealth management. Its potential to drive revenue growth and improve operational efficiency makes market data integration an essential element for the future success of wealth management and FinTech companies. Global research and statistics speak for themselves.

According to Markets and Markets, the global market data integration market is projected to reach $19.6 billion by 2026, growing at a rate of 11.00% during the forecast period. The main drivers are:

- The rise of big data and cloud computing technologies.

- The increase in the volume of data generated.

- The inability of traditional data management tools to handle such volumes and different types of data.

Thus, in the next few years, we expect the use of wealth management data analytics to become more widespread. This is anticipated to have a transformative impact on the entire wealth management industry. Specifically, it will enable the personalization of investment strategies and provide advanced predictive capabilities. Additionally, it will facilitate real-time market monitoring and decision-making and seamless integration with external data sources. Ultimately, this will lead to complete ecosystem integration and a new era of personalized, data-driven investment strategies.

Click on our latest article on Wealth Management Trends in 2023 to discover other key trends shaping wealth management in the near future.

Conclusion

The dynamic world of FinTech wealth management highlights the significant role of market data integration. This offers many benefits, including real-time decision-making, customized investment plans, and increased customer satisfaction. Yet, navigating the challenges of data volume, quality, and compliance requires expertise. That's where ElifTech steps in. Our industry-leading solutions and experienced team are here to help you navigate the complex nature of market data integration.

Contact us to set up a free consultation with one of our experienced consultants.

Browse our case studies and get actionable insights to drive your success

See more