FinTech

How to Approach Mobile Banking App Development in 2023

Before the advent of mobile banking app development, all questions had to be solved at the branch. Clients had to stand in line, fill out a bunch of paperwork, and ensure everything was correct. Now all you need is your mobile device – a transfer or balance check takes less than a minute. When users discover mobile banking apps, it turns out they can make managing money easier and more convenient. If you plan to conquer Fintech and the world with your digital and secure mobile banking application, begin your journey with this article. You will learn about successful examples and must-have mobile banking app features, as well as understand the mobile banking app development cost and development time.

Market stats for digital banking app development in 2023

The mobile banking app is a service that allows you to manage your bank account, send and receive money, view previous transactions, and pay bills. To do this, you only need your mobile devices - phone or laptop. The target audience of such platforms is people of different gender, ages, and places of residence who use banking services. There are three types of mobile banking apps:

● For private transfers (PayPal, Venmo),

● For old-school banks with physical branches and ATMs (Raiffeisenbank),

● For Internet banks without branches (Chime).

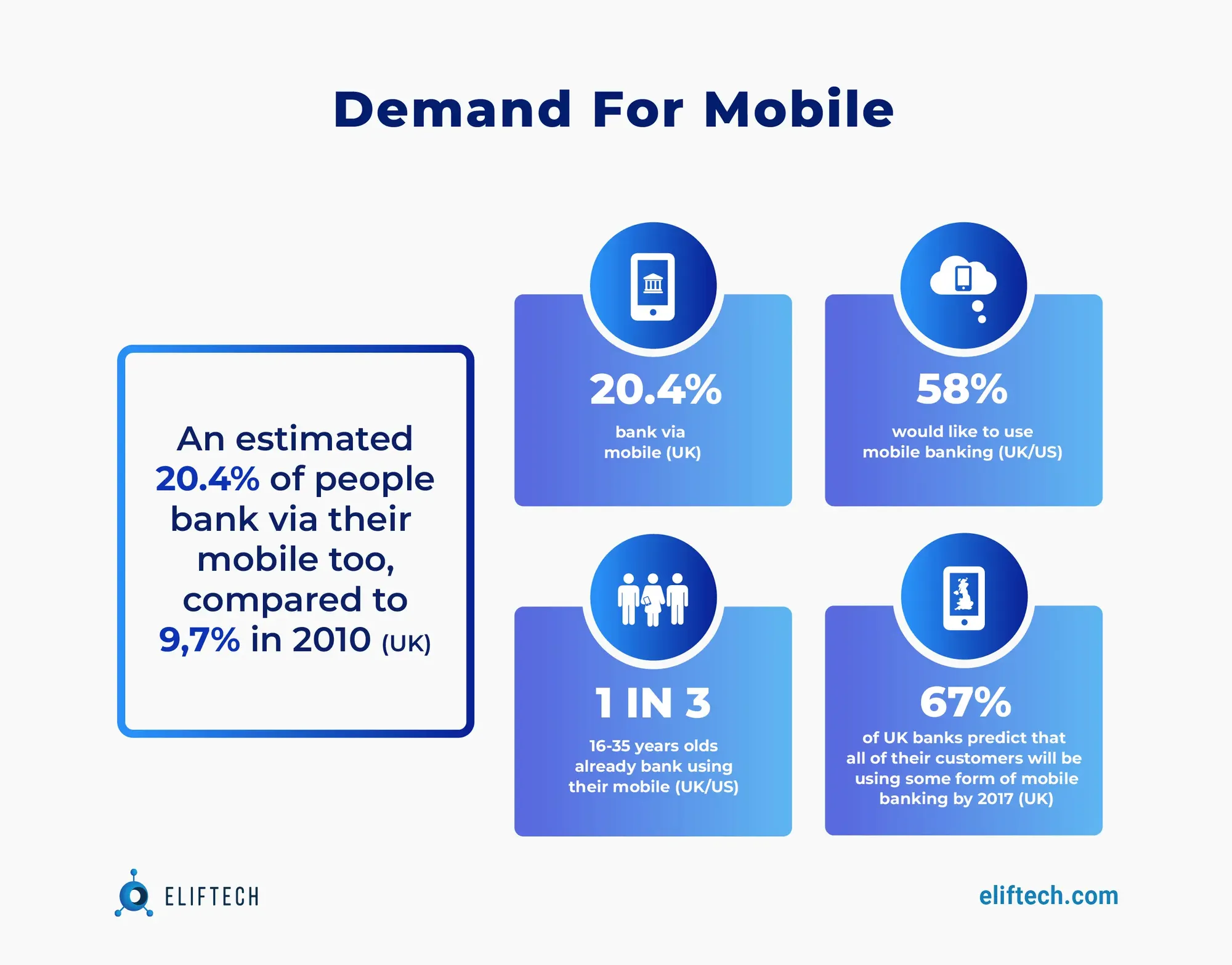

Nowadays, banking mobile app development is practically a must for any self-respecting financial institution. Statistics on mobile banking applications and their development derived from Statista, FDIC, J.D. Power, Galileo, and U.S. Federal Reserve show that:

● Nearly two-thirds (65.3%) of U.S. citizens use mobile banking application.

● While almost 80% of world millennials reported using mobile banking application in 2022, only 48.5% of baby boomers worldwide reported the same.

● The number of mobile banking application and digital banking users has increased by 4% starting in 2018. Mobile banking software development has become a flourishing segment since then.

● Off-line and IRL banks aren't obsolete yet. Of those who prefer mobile banking application, 79.9% still visited a branch in 2019.

● About 27 % of Americans use an online-only bank.

● 88% of online-only bank users reported satisfaction with the bank’s services.

● Meanwhile, only 66% of users report being completely satisfied with traditional banking services.

● Americans, on average, have 5.3 bank accounts across financial institutions.

● Around 5% of U.S. citizens are unbanked, meaning they have no bank accounts.

Traditional banking vs. Digital banking

Traditional banks have a physical presence, and many of the largest U.S. banks, including JPMorgan Chase and Bank of America, are considered classic. On the other hand, online banks do not have branches and offer services via desktop websites and mobile banking apps.

The fintech Galileo found that 65% of consumers use traditional banks for their primary bank accounts, while J.D. Power reports that 27 % primarily use online banks. However, 77% of those who primarily use traditional banks said they keep some of their funds elsewhere. Here are the differences between traditional and online banks and their advantages:

Why do you need a mobile banking app?

The fintech market is growing rapidly, and the number of users is increasing daily. Due to the convenience and ease of use, more and more people are turning to internet banking. 76% of Americans have used a banking app in the last 12 months. Most of them are between 21 and 49 years old. Mobile banking applications are used in many countries. Asia is considered the most developed mobile banking app market: China and South Korea are leaders in the number of users and transactions. However, they are not far behind the United States, Denmark, India, and Sweden. Therefore, developing a mobile banking application for Internet banking opens up access to an audience worldwide.

Last but not least, it's easy to create an efficient online banking application with minimal features. For example, statistics show that most clients use only three elements: transferring money between accounts, checking the current balance and history, and making deposits and checks. Therefore, if you plan to develop a mobile banking application, we recommend focusing on these three elements.

Can you develop a digital banking app that is profitable? In short, yes. Like regular banks, banking apps charge a fee. For example, account maintenance fees, a commission for international transfers, currency exchange, and customer deposits and investments fees.

Let's look at the earnings of the big players in the market. In 2021, the Brazilian NuBank app earned $963 million, while the American Chime earned $600 million. They are followed by Revolut, with $361 million and $160 million, respectively. Market opportunities and rapid audience growth make the question of “how to make a banking app?” a relevant one, and mobile banking app development is an attractive industry for investors and ordinary users.

Mobile banking app development: A roadmap

Modern banking app makes the interaction process flexible and convenient, regardless of the time and location of the branch. And with the growing demand for banking services, traditional institutions need to keep up with current mobile banking trends to retain existing customers and attract new ones.

Set the initial mobile banking app features

Consider the key features in advance to help your project fight off the competition and meet users' needs. For example, the target audience may fall in love with a user-friendly interface, simple navigation, and efficient design, which will allow the app to break into the top marketplace charts.

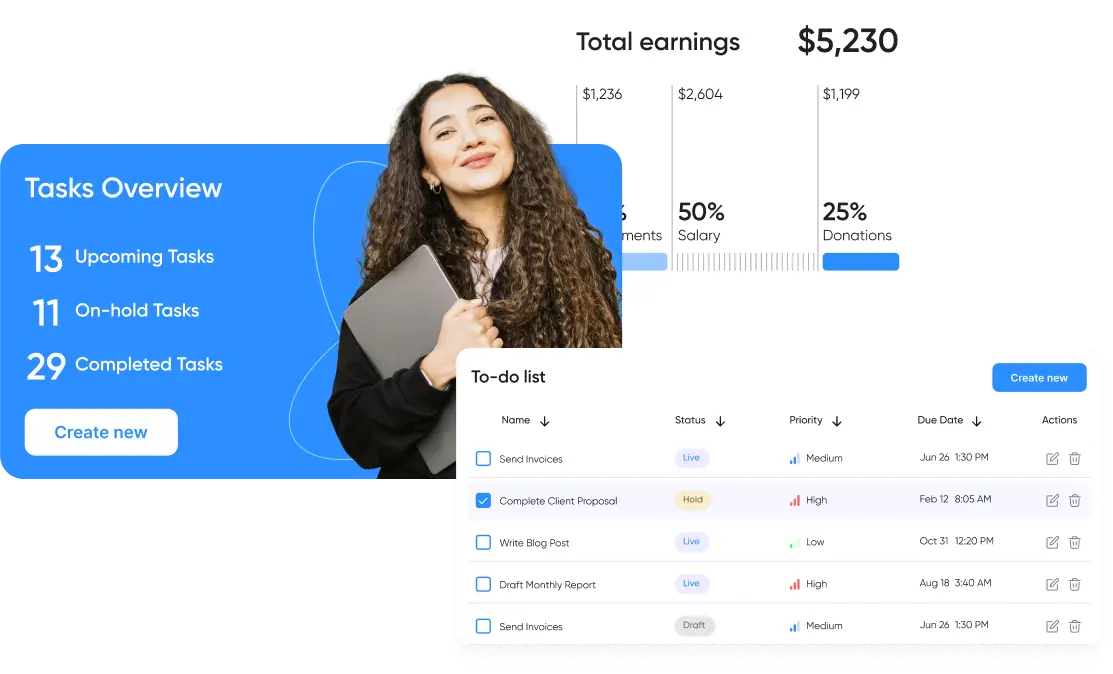

1. Dashboard with current balance: A dashboard's main purpose is to communicate important information quickly. For a positive experience with the application, users should be able to access the numbers as soon as possible. For example, the first thing they see when they enter the app is the amount of money in their bank account. Creating a dashboard for online banking with a bunch of tools and numbers is not an easy task. The first step is to think strategically about the layout, color scheme, important widgets, and interactive elements. Check in advance whether your mobile banking application development team has experience with similar features and whether they know current trends.

2. Transaction history: Users want transparency when it comes to finances. They need to know where the money went and be able to see the payment history. Therefore, page navigation should be simple and clear. Keep this in mind when developing a mobile banking app.

3. Authentication and authorization flow: Multi-level authentication and user biometric authentication data, such as fingerprints, appearance, voice, and gestures, are the most recent trend. Two-factor or multi-level authentication is a technology that helps to verify the person who enters the application. Some examples include using a password, FaceID, or a six-digit code from SMS. Two-factor authentication in mobile banking apps helps protect user-profiles and makes it harder for data to be stolen. Therefore, most companies strongly ask customers to enable this feature to protect their money.

4. Secure mobile application payments transfers and transaction processing: According to statistics, almost a third of all Internet users transfer money and pay bills via online banking. When developing a mobile banking application, this must be taken into account. Generally, to make secure payments on the platform, you need another user's ID: email address or phone number. Transfers between banks and countries will also require additional information about the recipient, bank, and account. Apart from that, all mobile payments and transactions bill payments must be secure and accessible at any time, regardless of location. Adding mobile application payments using a Q.R. code is a great solution.

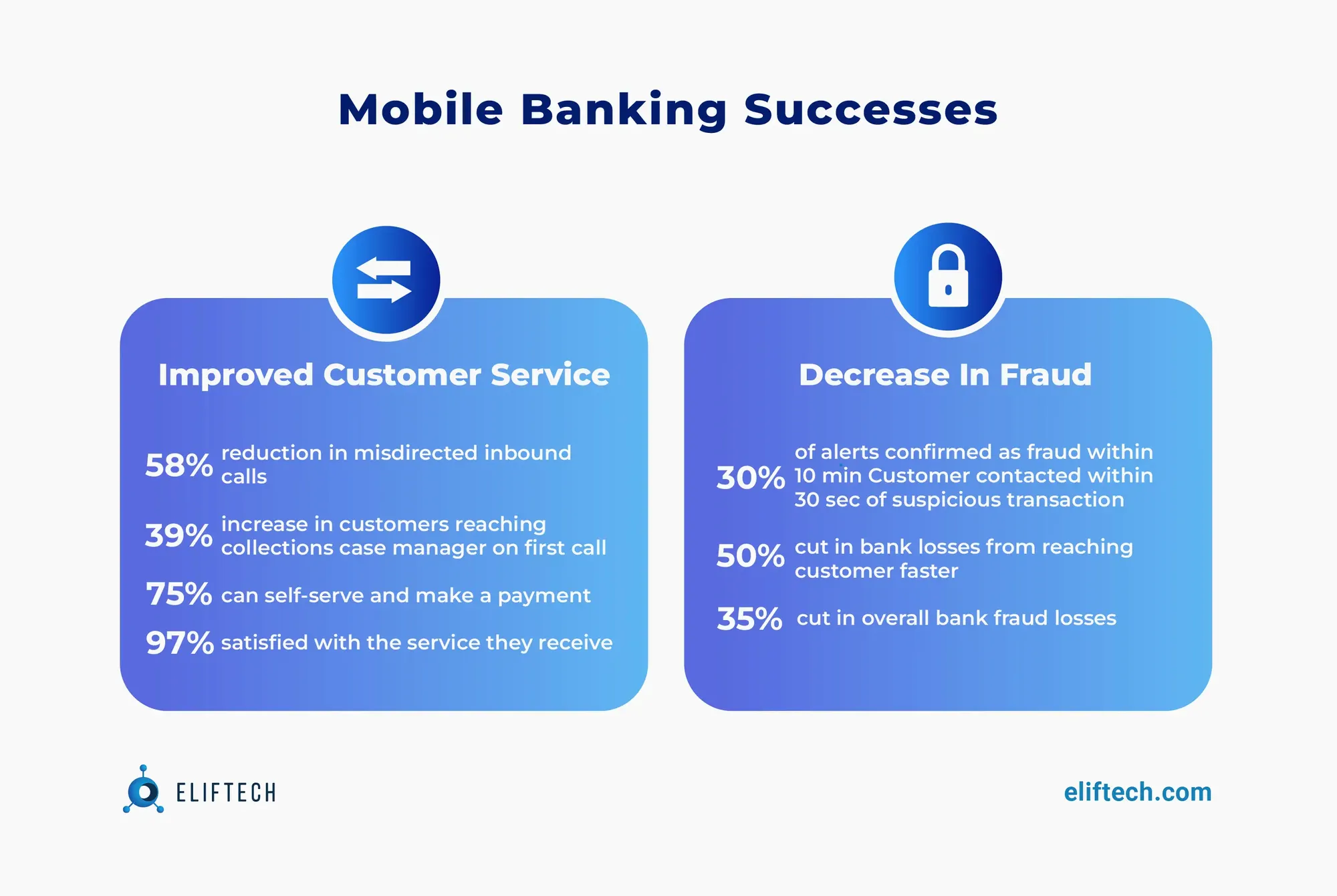

5. Support service: Make sure customers can contact support managers 24/7 to resolve their issues. Remember that most financial problems need to be addressed urgently. For example, when a user notices in their profile a suspicious payment that they did not make, they likely want to call the bank immediately to sort out the issue. In such cases, users certainly do not want to wait in line for half an hour. A friendly and competent support service in a banking application will help build trust with the audience and make users feel secure. This feature should be carefully planned while developing mobile banking apps. In addition to frequently asked questions, consider a simple chatbot that can help you quickly find answers to basic questions about products. Users can email support in the Wells Fargo app, read FAQs, or make an immediate branch appointment.

6. Account Management: Help users see their bank balance, track spending, record history, and analyse their habits. You can go even further by introducing more robust mobile banking application development and asking people to set savings goals, create investment plans, and automate recurring payments.

7. Cost counters & cashback services: It is always good to keep your financial situation under control. Help people stick to their budget and save more money. Mobile e-commerce is predicted to reach $3.5 trillion by the end of 2022, accounting for 72.9% of all e-commerce sales. The cashback will encourage bank users to make application payments and become part of your loyalty program.

8. Peer-to-peer transfers: Direct payments are one of the main benefits of banking apps.

Millennials see this as a huge value, and it can help you retain loyal customers and make it easier for your banking app to take off. For example, when transferring directly to an individual's bank account, clients have to enter some details such as bank account number, routing code, account holder's name, and others. However, most peer-to-peer payments in mobile apps work only with phone numbers or email addresses, which simplifies the process. A good example is PayPal. This easy way to transfer money can help you get more customers and drive growth.

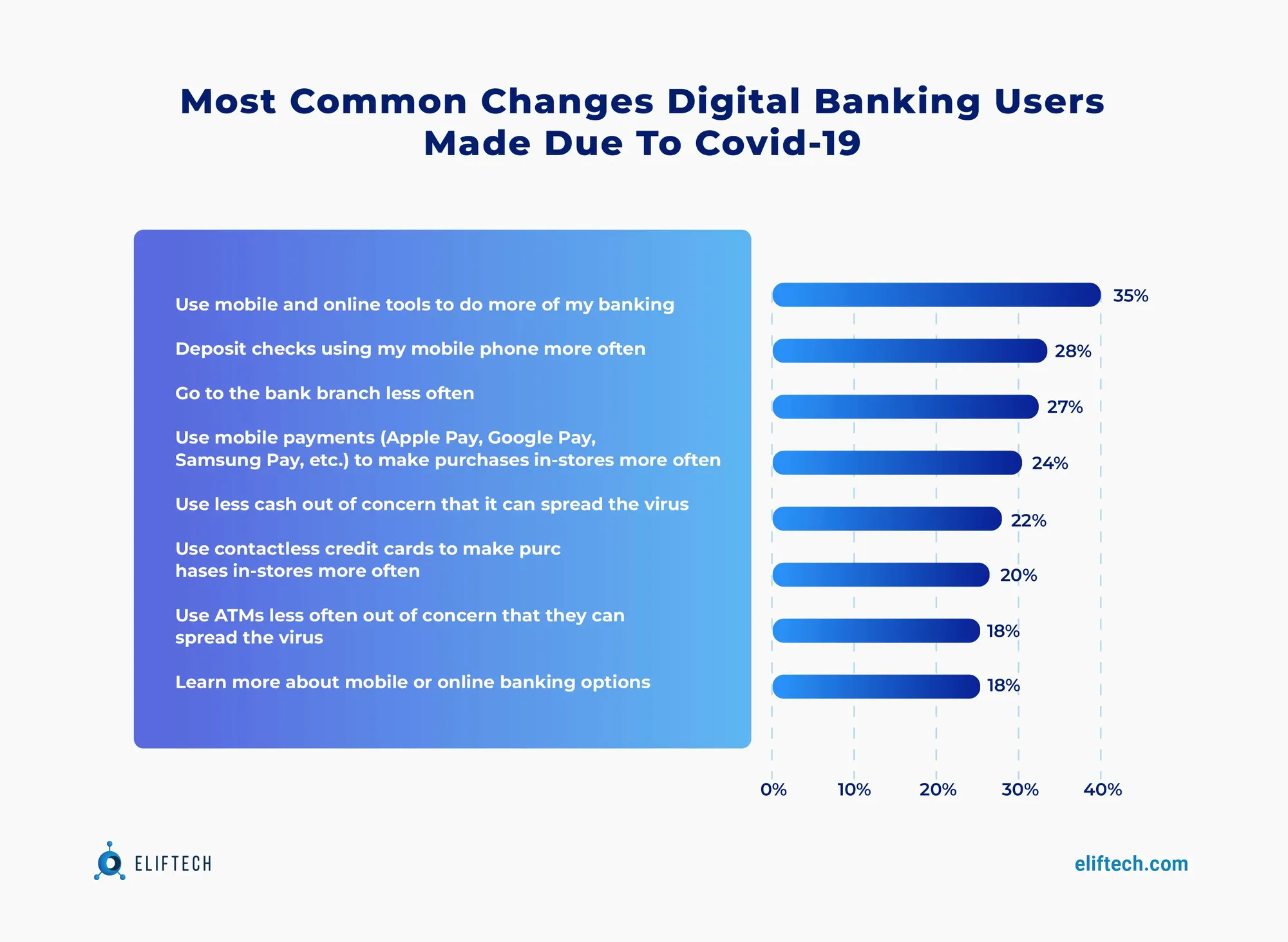

9. Bill splitting or separation of accounts: The bill splitting feature allows you to split bills and determine their value to the cent. It is one of the recent "hits" of the banking industry, brought to us by the rise of neobanking and the general trend of "online-only" services and collaboration options. It became extremely popular amongst users during the pandemic and, since then, hasn't lost its potency amongst the end-user.

10. Chatbots and voice menu: Do you feel like crying at the thought of going to the bank? Banks are open only on weekdays and, as a rule, there are long lines, so people sometimes have to leave their offices earlier to go to the banks. This can be an obstacle and a big waste of time. When embarking on mobile banking app development, remember that you can easily resolve a number of your customers’ issues with an online banking app equipped with a chatbot. Chatbots can solve problems at any time of the day and offer the ability to get tickets directly from the app. Since you want to offer everything using just one mobile app, your customers will save time on banking and banking matters. For informational and transactional purposes, voice chatbots for digital banking provide an attractive, advanced, and lively user interface.

11. User notifications: An unprecedented year provoked rapid digital changes, with 39% of banks turning to mobile application development compared to only 10% opting for traditional banks. In addition, payment or banking app sessions rose 27% in the U.S. alone between 2021 and 2022. Various stats show that even before the Covid-19 pandemic, 2/3 of mobile devices in America had one or more fintech apps. Even more, 55% of users had at least one full-service banking app. Fortunately, current development process allows push notifications to help create a seamless user journey. Below are five ways to utilize push notifications for the mutual benefit of banks and users.

● Transactional Updates - Informing users of their transactions should be a priority within your communications strategy. Transactional updates on the go keep users in the loop. They also build trust in your brand and strengthen the brand perception.

● Security Push notifications - Flagging fraud is a number-one concern regarding mobile banking development security. Send security push notifications to inform users of any suspicious activity in their accounts. Users report appreciation for spotting fraud instantaneously and taking action to protect their accounts.

● Major Account Updates - Mobile push notifications can notify users of any change to their accounts. Also, they can be used to remind clients to monitor their reports and investment histories routinely.

● Bank Communications - Your mobile banking app can flawlessly mirror the traditional banking experience. One thing you'll need to connect your users with their wealth and personal account management payments teams via the app.

12. Financial Planning, Support, and Investment Tips: While using customer data to benefit your UX, be cautious with personal information when pushing offers or sending marketing messages. Because financial institutions deal with Personally Identifiable Information (PII), protecting and respecting user privacy and providing flawless data security is important. As you build your messaging strategy, carefully review privacy regulations and ensure that your system aligns with regulatory requirements.

13. Speech recognition: From 2012 to 2016, the volume of the human voice verification and identification market increased from $229 million to $697 million. This growth is primarily maintained by banks. They now use three voice technologies that do not require special equipment, simplify work with accounts and speed up the provision of services. This article is devoted to the areas already used in the banking sector today. There are three voice technologies that do not require special equipment, simplify the work with accounts, and speed up the provision of services. According to the forecast of Grand View Research, the global market for voice identification and speech recognition technologies will grow to $127 billion by 2024. This will be ensured by the technologies listed above and the development of automated systems based on natural languages, such as Amazon’s Alexa.

Keep up with the changes: Mobile banking trends of 2023

Mobile banking trends show insane ambition that leads to growth and development. Statistics convincingly demonstrate that by the end of 2022, the sheer number of mobile device users will reach 7 billion, while 3 billion will switch to mobile banking. The world leaders that prompted the change of the rules of the banking game include Citibank, Wells Fargo, Ally Bank, and Capital One. The famous PayPal is the most used mobile payment or banking app (73%), and Samsung Pay is the least used (6%).

According to one of the world's largest British audit and consulting firms Ernst & Young, 50% of consumers are going digital when applying for financial products. Mobile payment transactions will reach $189.97 billion by the end of 2021, according to Statista. And this is not surprising since, due to the COVID-19 pandemic, 55% of people will switch to a contactless payment method. An Insider Intelligence study of the mobile banking software market found that 89% of all respondents and 97% of millennials - said they used mobile banking. But it’s not just the younger generation that trusts web banking: 91% of Gen-Xers and 79% of Baby Boomers see the benefits of digital banking.

Doing market analysis and project planning

Users are more willing to complete surveys and leave feedback in the app, which makes it great for testing new financial products. You can collect statistics on the functionality updates and refine them. Plus, based on analytics data, you can divide users into categories according to different parameters and set up targeted offers. Cashback and bonus mobile banking app features will benefit all customers and be a strong argument for choosing your online banking application. Ask users' opinions about the application, collect statistics and improve the service.

User-friendly UI/UX designing

The more users you want to attract to your application, the easier it should be. Intuitive navigation with a minimalist mobile banking app design can help users understand and use your online wallet and mobile banking solution. You must realize that not every user of your application will be tech-savvy, so you have to make sure everyone who downloads the banking app can use it with ease. Therefore, focusing on simplicity is the best way to discover mobile banking apps. UI/UX design should be modern and simple. Nobody likes to go to banks because they are slow and complicated. Digital banking has changed the game rules and shown that managing finances can be fun. Make a banking app the one that is easy to use and visually appealing with a neat and consistent interface design. In addition, good design will help users receive a positive experience with the application and will be an advantage for the entire startup.

Offer advanced-data protection

Online banking applications facilitate authentication by providing the same level of security as logging in with a password and SMS confirmation on a website. In addition to two-factor authentication, you can add a biometric authentication such as face scan or fingerprint login. All data that the application will transmit must be securely encrypted, and all operations must occur only after entering one-time passwords, reading a Q.R. code, or recognizing a face/fingerprint. In addition, consider adding an auto-lock function for cases when the smartphone breaks down or when there have been several unsuccessful login attempts. Finally, reducing vulnerabilities is necessary if you work with other people's money. Potential leaks and hacks will immediately alienate people from your platform. Therefore, find out in advance if your mobile application development team already has experience in the field of cybersecurity and knows how to create a banking application with proper security measures.

Mobile Banking Challenges: Competitors, Regulators, and Fraudsters

Given the growing importance of digital technologies, it is necessary to be mobile. Neo-banks combine all qualities of a good bank, but how long will the trend last? After all, competitors are actively introducing innovative services. Moreover, regulators worldwide expect from financial startups as much as from their more experienced counterparts and sometimes even more.

Mobile banking and regulatory issues

There is a global trend in the banking sector: it is becoming more regulated. This means that banks need to comply more and more with regulations to remain "reliable." The need is significant for mobile banking since their activities involve rather atypical procedures for identifying customers, signing contracts, maintaining documentation, etc. If any of the ongoing process are carried out according to a simplified procedure, they will receive more and more attention over time.

The need to go legit: Licensing

Over the past few years, mobile banks that previously operated based on identified financial institutions (for example, N26) and those that require an EMI license to issue electronic money (for example, Revolut) have received real banking licenses. They include Atom Bank, Tandem Bank, and Starling Bank. On the one hand, this has expanded the range of services banks offer to their families. On the other hand, it has made them vulnerable to new security threats and regulations, which embrace the tightening of international law. Neobanks that continue to operate with an EMI e-payments license or are authorized payment marks are not subject to bank limits yet. However, in the future, we can expect new rights and opportunities for financial companies of this type.

Open banking: The brand-new thing or nuisance?

Many European mobile banks have already opened their APIs, expecting to be able to exchange data with larger financial institutions and thus gain potential access to their user bases. Soon, neobanks will need to comply with the new requirements of the PSD2 directive. SCA (Strong Customer Authentication) technical, regulatory standards were introduced in 2019. To confirm online payments and bank transfers, you must use at least three parameters: password, phone number, and biometric indicator. Neobanks that have moved all transactions to a smartphone need to be ready for a new identification system.

Anti-money laundering: The financial plague of the century, and how to fight it

Still, one of the main banking trends in 2019 was the fight against money laundering and the difficulties in working with offshore companies. So, banks are now preparing for a new version of money laundering legislation (AML, Anti-Money Laundering). In addition, European countries must integrate the 5th Anti-Money Laundering Directive (5MLD) into their legislation. This means that banks need to decide how they will implement the requirements of the new directive in their compliance systems. Among them is the verification of the ultimate beneficiaries of companies and additional verifications of clients from high-risk countries. Of course, these requirements will also apply to banks in the smartphone.

In addition, mobile banks that work with prepaid payment cards should consider that the new directive implies more thorough checks and new restrictions for such payment instruments. Experts believe that, unlike traditional banks, it is more difficult for mobile financial institutions to achieve AML compliance and maintain a balance between rapid growth and security. In addition, large institutions may simply allocate more staff and money for compliance. Compliance is not a matter of technology reliability but an issue of corporate culture, and regulatory requirements are becoming tougher. In such circumstances, banks will have to meet the requirements and offer customers convenient functionality. And this task can be even more difficult.

The most common issues of banking mobile app development

When neobanks first appeared, their service was innovative, and their service fees were unexpectedly low. However, with the development of technology and awareness of the digital trend, mobile banks began to have serious competitors. As a result, service prices had to be raised because every bank, even the one without branches, has costs.

The problem of monetization

All tech startups face a common problem. First, they gather an audience, which is often done with strategies like price dumping. And after that, they think about monetization. Revolut, which originally entered the market as a bank for profitable international money transfers and travel, is now forced to introduce hidden fees. This provokes an outflow of customers.

Increasing competition in digital banking

Large financial institutions have more resources for more than just compliance issues. They willingly invest in the development of their own digital channels. And if they wish, they can deploy a separate digital bank based on their license. For example, last year, the financial holding JPMorgan Chase launched its own mobile bank, Finn. True, it turned out to be not competitive enough, and a year later, it closed without offering anything unique to customers. But the threat is obvious: the more players there are in the mobile banking market, the more difficult it will be for them to surprise their clients.

This will create a growth threat – banks that did not bother to create a bank app will not be able to poach customers from each other because of the same functionality. And the conservatism of the majority of contributors will limit the attraction of an audience from outside. After all, loyalty to a traditional bank is still much higher than to a mobile one. Surveys show that less than 10% will pay attention to mobile banking when opening an account. Also, the threat may arise from financial companies. While neobanks continue to expand their pool of services, fintech companies from the investment and lending sectors have decided to get into banking. For example, the investment startup Acorn recently offered debit cards to its customers to store funds. Acorn has received 100,000 orders from its users in just four days since the product launch.

Mobile banks should move in the same direction, offering value-added services to the client. Experts believe that mobile-only financial institutions should develop in the field of analytics and artificial intelligence, collecting information about transactions. The real value lies in the data you get from analyzing behavior. For example, a simple mobile bank is currently working on adding artificial intelligence to its bill payment service. This will allow you to predict the future expenses of the clients and offer them advice on the efficiency of payments.

Safety: It was always about “Better safe than sorry!”

Mobile banks must be secure. They cannot afford to suspend customer service due to technical failures and hacker attacks, and these cannot be avoided. The first major risk smartphone banks face is hacker attacks. This is not critical for offline banks because they can say: "Our website is down. Contact the branch." Mobile banks cannot explain to their clients that there are some technical problems and that they will restore everything in 20 hours. It is also necessary to protect the mobile bank from internal leaks - fraudsters often turn to employees directly with an offer to "merge" the database. The larger the neobank business, the more serious its protection systems against failures and fraudsters should be.

Final Thoughts: Let's recap why mobile apps are so important to banking

Besides the obvious 24/7 access, easy viewing of the transaction history, the ability to pay bills and transfer money in one click, reduced operating costs, improved quality of customer service, good return on investment, and the option to personalise services for financial institutions, neobanking, and online-only financial tech also bring:

#1 Transparency: Every time a user withdraws or sends money via an app, the transaction is fast, and the balance is updated in seconds. Users can see exactly how much they have spent and check their goals. This helps maintain some form of transparency between the user and online banking systems.

#2 Fraud Protection: Since the entire bank would only be online, the hackers could focus on it. For this reason, the bank can direct all its efforts to providing additional security and protection against fraud or unethical hackers. This will ensure the safety of user accounts from all sorts of hacking attempts and fraud.

#3 Simple Registration: What is the process of opening a bank account? It's paperwork, long lines, bank trips, paperwork, personal verification... and did we mention paperwork? But how to open a bank account in a digital bank? It takes 10 minutes to scan copies of some of your documents, and here it is! Easy registration and simplicity go a long way, especially for people whose schedule or lifestyle doesn't allow a visit to the bank.

#4 Freedom of movement: With physical banking, costs continue to rise. There are bills to pay; new branches will be built in every city, thus monthly wages, and much more. But with a digital bank, you can only have one large office and perform all the functions from there on your own. Moreover, thanks to the savings, you can offer free services and 0% commission on all user transactions.

#5 Accelerated Processes: Traditional processing or banking processes take more time to complete. With manual errors, rework is another thing that takes up most of the time caused by delays. However, in digital banks, most processes are connected to the network and help improve accuracy and speed.

Given all listed above, it becomes apparent that it's time for people to get the online banking services they deserve. You can achieve that by utilizing the right tech stack and expertise of a seasoned app development company. At ElifTech, we provide a high-quality mobile banking app development services and custom mobile banking applications that allow you to maximise profits and offer the best services simultaneously.

Utilizing a powerful technology stack, ElifTech leverages native app development and cross platform development techniques to offer secure and efficient banking application development services. Our adept team of mobile developers and financial app developers cater to both Android and iOS platforms, ensuring seamless transactions, bill payments, and a user-friendly experience.

As a leading software development company, we focus on creating banking software that achieves uniformity and consistency across various platforms, with attention to security and tailored solutions.

Ready to bring your banking software idea to life? Then stop hesitating and contact our app development company for a consultation. Partner with ElifTech to revolutionize mobile banking app development for your customers.

FAQ

Browse our case studies and get actionable insights to drive your success

See more