FinTech

Exploring How Personalized Banking Is Changing the Industry: A $20 Trillion Breakup Opportunity

The world has changed, and so have consumers. Today’s customers demand more personalized experiences when they shop online or in-store, so these companies must deliver on this expectation to stay competitive. The same is valid for banking.

The banking industry is ripe for disruption. A growing number of consumers are looking for more personalized financial services and convenient ways to manage their money, which is why fintech companies like Amazon, Google, Microsoft, PayPal, and Spotify have gained traction in recent years. But banks are still holding on to outdated methods that don’t always align with the needs of their customers.

But what if banks could use technology to create a more customer-centric approach to finance? We call this the “new finance” because it is built on technology. All of these areas represent opportunities for banks to shift to personalized banking by partnering with fintech companies or using them as an alternative channel to reach customers—or even enter themselves.

The banking industry is undergoing a shift marked by fundamental restructuring, but the banks that successfully embrace this change will scale and reach significantly higher profits—and grow faster with a value creation opportunity of up to $20 trillion (according to recent McKinsey research).

Understanding Personalized Banking

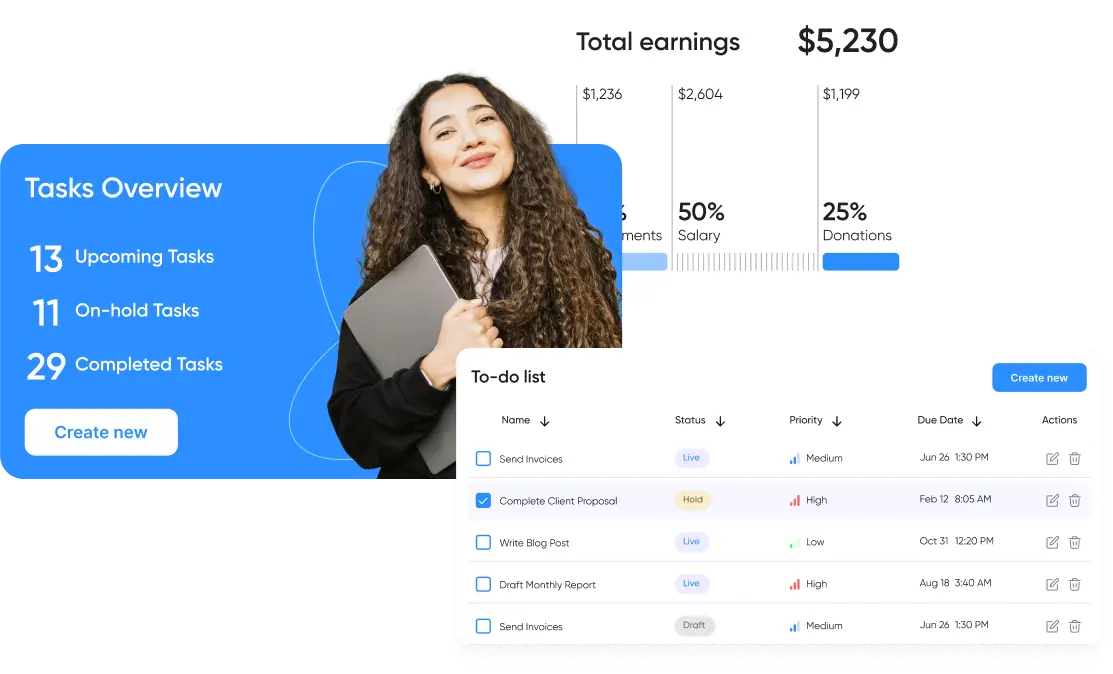

Personalized banking is a service that allows customers to tailor their banking experience based on their needs and preferences. This can include using mobile apps that feature your name instead of “John Doe” or “Jane Smith” to getting tailored offers based on your spending and saving habits.

The idea is that banks can create a better experience for their customers by providing them with more personalized and easier-to-use features through custom banking solutions. The technology behind this comes from machine learning algorithms that process data about each customer’s spending habits, credit history, and other factors to create a unique profile. This information is then used to make recommendations based on what products or services might be most helpful at a given time.

Machine learning helps banks monitor activity better, build customer profiles, or predict future spending habits. By leveraging big data, banks can foresee future outcomes, understand customer needs better, and create more impactful and personalized banking services.

For example, if a bank knows that someone has just gone through a divorce, it can use that data to offer them financial advice on managing their finances in the new situation. The bank can also use this information to create a one-to-one relationship with its customers. This means that it can offer them financial advice and products tailored specifically to their needs rather than giving them generalized advice that may not be relevant to their situation.

Banks can use custom banking solutions to better serve their customers by offering them more personalized services. This means that banks need to understand what data they have and how they can use it to create these profiles. The more banks try to learn about their clients and facilitate complex banking operations — the higher customer loyalty will be.

But this daunting reorganization, or breakup—whatever it turns out to be—could also provide banks with higher margins and new sources of revenue.

Banking Is Losing Its Traditional Advantages: Key Trends Driving Personalization in Banking

Banking has traditionally been a one-stop shop, but many banks have failed to keep up with tech-driven changes in other industries.

Banks and nonbanks will compete in five cross-industry competitive arenas: everyday banking, investment advisory, complex financing, mass wholesale intermediation, and banking as a service (BaaS). According to McKinsey research, “The new arenas will require banks to ramp up their presence on new platforms, create touchpoints with customers, and mine and capture data in new ways.”

The five new competitive arenas will provide banks with opportunities to create value, but they also present challenges. Banks will have to build new capabilities around these areas and also integrate them into their existing business models. Fintech companies are already starting to enter some of these spaces, so banks will need to act quickly to succeed in the future finance landscape.

Banks need to move from a product-driven approach to one that focuses on customer experience. They must develop new ways of interacting with customers, such as by offering personalized financial services that are tailored to individual needs and preferences. Banks also need to provide a consistent experience across all touchpoints, so customers don’t feel confused or frustrated when switching from one channel to another.

In order to compete in these areas, banks need to reevaluate their models and understand the technology they will need. They should also focus on creating a digital customer experience that is more personalized and tailored than ever before. The opportunities are vast—but so are the challenges.

Read more: How open banking boosts the US FinTech sector?

How Personalized Banking Impacts the Industry

Banking personalization is a key factor in attracting new customers and retaining existing ones. The ability to provide tailored, personalized customer experiences can also help banks reduce customer service and support costs. This is because custom banking solutions are often easier to sell than generalized ones, which means that banks can reduce the need for manual input by sales representatives or call center staff.

For example, everyday banking is the arena in which consumers interact with their banks most frequently. It’s also the area where banks can make the most significant impact by focusing on sites such as security, usability, and personalization.

The biggest challenge for banks will be finding ways to meet customer expectations for ease of use when managing their money online or through a mobile device. Banks need to provide customers with simple, intuitive products that allow them to access accounts and make payments quickly—without having to download new software or sign up for multiple accounts.

According to McKinsey research, “The common thread of all these services is that customers want them to be hassle-free, reliable, highly automated, and inexpensive in their day-to-day life. The ultimate goal for everyday banking is invisibility—offering services that are cheap and easy and accessible through all channels”.

The era of large, all-encompassing banks is over. With the emergence of “new finance”, banks need to become more agile and responsive than ever before. They must rethink their business models and go through a digital transformation that will involve significant investment in technology. The banks that succeed in this new era of finance will be those that can adapt to a customer-centric approach and develop a digital ecosystem that allows them to offer customers the right service whenever and wherever they need it.

Delivering the right individual experience at the right time through the correct channels can go a long way. It helps build trust and a more beneficial relationship with customers, and in turn, it can boost revenue growth.

Personalized Banking in Action

Out of plenty of personalized financial services, we’d like to focus on the top 3 most efficient ones.

Digital Customer Support

Digital customer support is one of the fastest-growing areas in fintech, with many companies offering automated solutions that can help customers in various ways. For example, some companies are building chatbots that can assist with basic inquiries such as “how do I open an account?” while others offer more advanced capabilities that include voice recognition and image analysis. Banks need to consider how these technologies could be used to streamline operations and reduce costs while improving customer experience.

You can’t talk about personalized banking services without mentioning virtual assistants and AI-powered chatbots. These are two of the biggest trends in banking today. Virtual assistants are AI-powered chatbots that can answer customer questions, help them with financial tasks, and provide them with personalized advice based on their data and profile.

While some banks have launched their own virtual assistants, others have partnered with third-party companies to offer this service. Some of these partnerships include Amazon’s Alexa and UBS’s MoneyTwin.

Investment Advisory

Investment advisory is another area where technology has already begun to have an impact. For example, robo-advisors are emerging as a cost-effective way for banks to offer investment advisory services while providing clients access to a broader range of investments than they could provide themselves.

Banks can also use technology to help advisors manage their clients’ accounts more efficiently. For example, banks can use artificial intelligence (AI) to help advisors identify opportunities for improving performance by identifying client behaviors inconsistent with their investment goals.

The goal of investment advisory is personalization—blending the human touch with digital efficiency, - McKinsey Report.

Banking Security Services

Another critical aspect of personalized banking services is a customized cybersecurity system. Banks are now providing customers with a personalized cybersecurity system that is tailored to their needs and preferences. This can include an app that allows users to control their banking data and block unapproved access, as well as automatic notifications about suspicious or unauthorized activity on their accounts.

For example, your bank account transactions are often within a specific range and location. If the system detects a significant increase in the amount you frequently transact, especially to an unknown location, it will be blocked. Only after the user verifies that they are responsible for that specific operation will it be allowed to proceed. This significantly helps to reduce fraud.

Read more: Open Banking App Ideas: Use Cases for Fintech Founders

Examples of Successful Personalized Banking Strategies

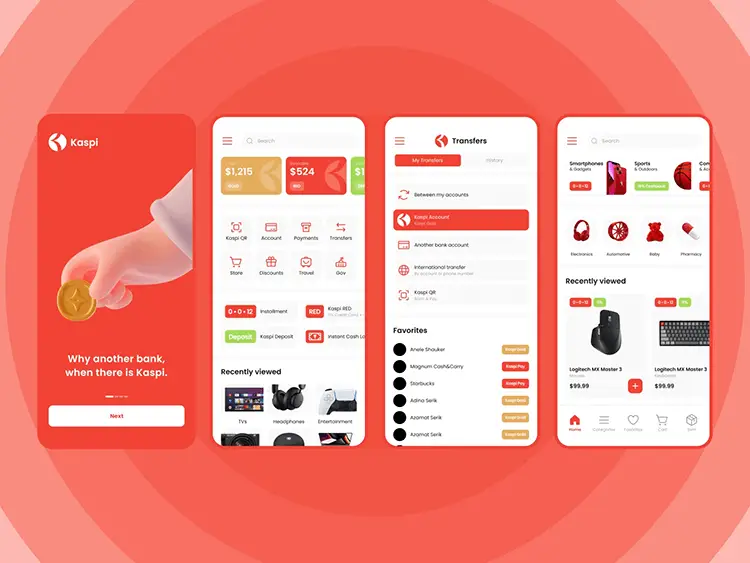

Kaspi Bank

Kaspi is an example of a traditional bank that has successfully transformed itself into a digital platform. Kaspi's success can be attributed to its customer-centric approach, which places a strong emphasis on user experience and convenience. The platform's mobile app allows customers to access a range of financial services with just a few clicks, and the platform uses data analytics to personalize its offerings and improve customer experiences.

Overall, Kaspi's success demonstrates the potential for traditional banks to transform themselves into digital platforms that offer a range of innovative services. However, achieving this transformation will require significant investment in technology and a willingness to embrace new business models and customer-centric approaches.

Monobank

One of the key ways that Monobank is transforming banking is through its mobile app, which provides customers with a user-friendly interface that allows them to access their accounts, make payments, and manage their finances on the go.

In addition to its mobile app, Monobank also offers a range of other digital services, including a virtual card that can be used for online purchases, cashback rewards for spending on certain categories, and instant loans that can be approved within minutes. The bank also uses artificial intelligence to analyze customer data and offer personalized financial advice and insights.

Another way that Monobank is transforming banking is through its customer-centric approach. The bank places a strong emphasis on customer service and is known for its responsive and helpful support team. Monobank also actively solicits feedback from its customers and uses this feedback to improve its services and tailor them to customer needs.

Read more: How to approach digital banking app development in 2023

Partnering with FinTech Companies: Why Is It Important?

To succeed, banks will have to change their traditional operating models. And it's here where fintech companies can play a key role. Fintech companies like ElifTech can help banks develop the capabilities and products needed to deliver personalized banking experiences.

Fintech companies are developing technologies that can help banks improve their customer service by providing insights into customers’ spending habits and preferences. For example, with the ability to collect information from various sources such as mobile phones, credit cards, and social media accounts, fintechs can build behavioral profiles for each customer. This data can then be used to create behavioral models that help banks design products and services that are tailored to each customer’s needs.

Fintech companies can also provide banks with the custom banking solutions and infrastructure needed for delivering new products and services. For example, fintech companies are helping banks develop mobile apps that allow customers to conduct banking transactions such as bill payments or money transfers from their smartphones.

Banks can also tap into fintechs’ expertise in areas such as risk management and cybersecurity. Fintech companies have developed innovative technologies that help banks detect fraudulent transactions, prevent identity theft, and protect customer data from hackers.

Consider ElifTech as your partner in delivering cutting-edge custom banking solutions for your bank or FinTech service. Let us know a project you have in mind.

Final Thoughts

Banking, for both companies and individual consumers, is experiencing a revolution that will change the way we use banking services. And that is why banks need to adapt and embrace innovations as technology continues to evolve.

This is the beginning of a new chapter in banking, driven by fintechs’ efforts to disrupt the industry. Fintech is changing the way we use money, from how we pay for things to how we manage our finances.

FAQ

Browse our case studies and get actionable insights to drive your success

See more