Wealth Management

AI in Wealth Management: Use Cases & Opportunities

Artificial Intelligence (AI) is currently experiencing a significant surge in popularity across various industries, and wealth management is no exception. AI and Machine Learning (ML) integration is reshaping the landscape of wealth management, offering a range of benefits for financial institutions and their clients.

So, how about we explore the hidden potential of AI in wealth management?

We will examine the innovative use cases and applications that are propelling the industry forward. We will highlight the tangible benefits of these technologies and also address the challenges standing in the way of their implementation. Also, we will explore how industry leaders can harness AI and ML to drive operational efficiencies and provide enhanced value to their clients.

Exploring the Potential of AI in Wealth Management

Machine learning, a subset of AI, is used in wealth management to analyze vast amounts of data, identify patterns, and make accurate predictions. By harnessing ML algorithms, wealth management firms can gain valuable insights, automate processes, and deliver personalized solutions to clients.

Over 80% of wealth management firms anticipate AI to have a substantial impact on their businesses within the next 3-5 years. This highlights the growing recognition of AI and ML as crucial drivers of innovation and optimization within the industry.

The integration of AI and ML in FinTech and wealth management is set to increase significantly in the coming years. From 2022 to 2032, it’s expected to grow at a compound annual growth rate (CAGR) of 16.5%, reaching US$ 54 billion.

AI & Machine Learning in Wealth Management Services

AI and ML technologies are being utilized in various aspects of wealth management services, revolutionizing traditional approaches. These technologies enable wealth managers to leverage vast amounts of data and extract meaningful insights, resulting in efficient operations and enhanced outcomes. Some key use cases include:

Main Benefits:

- Enhanced decision-making based on data-driven insights: ML algorithms can analyze historical market data, financial news, and investor behavior to generate insights and optimize investment strategies. This leads to more informed decision-making and improved portfolio performance.

- Personalization: AI-powered financial planning software can provide tailored recommendations based on individual goals, risk tolerance, and preferences. This level of personalization strengthens client engagement and satisfaction.

- Automation in wealth management: Routine tasks such as data entry, portfolio rebalancing, and report generation can be automated through AI systems. This enables wealth managers to focus on higher-value activities and provide better client service.

- Compliance and Risk Management: AI algorithms can analyze regulatory requirements, detect anomalies, and flag potential compliance violations. This helps wealth management firms streamline their compliance processes and mitigate risks.

- Increased operational efficiency and scalability. Artificial intelligence wealth management contributes to task automation, data analysis for actionable insights, and efficient decision-making. It streamlines processes, reduces errors, and enables firms to handle larger client bases effectively.

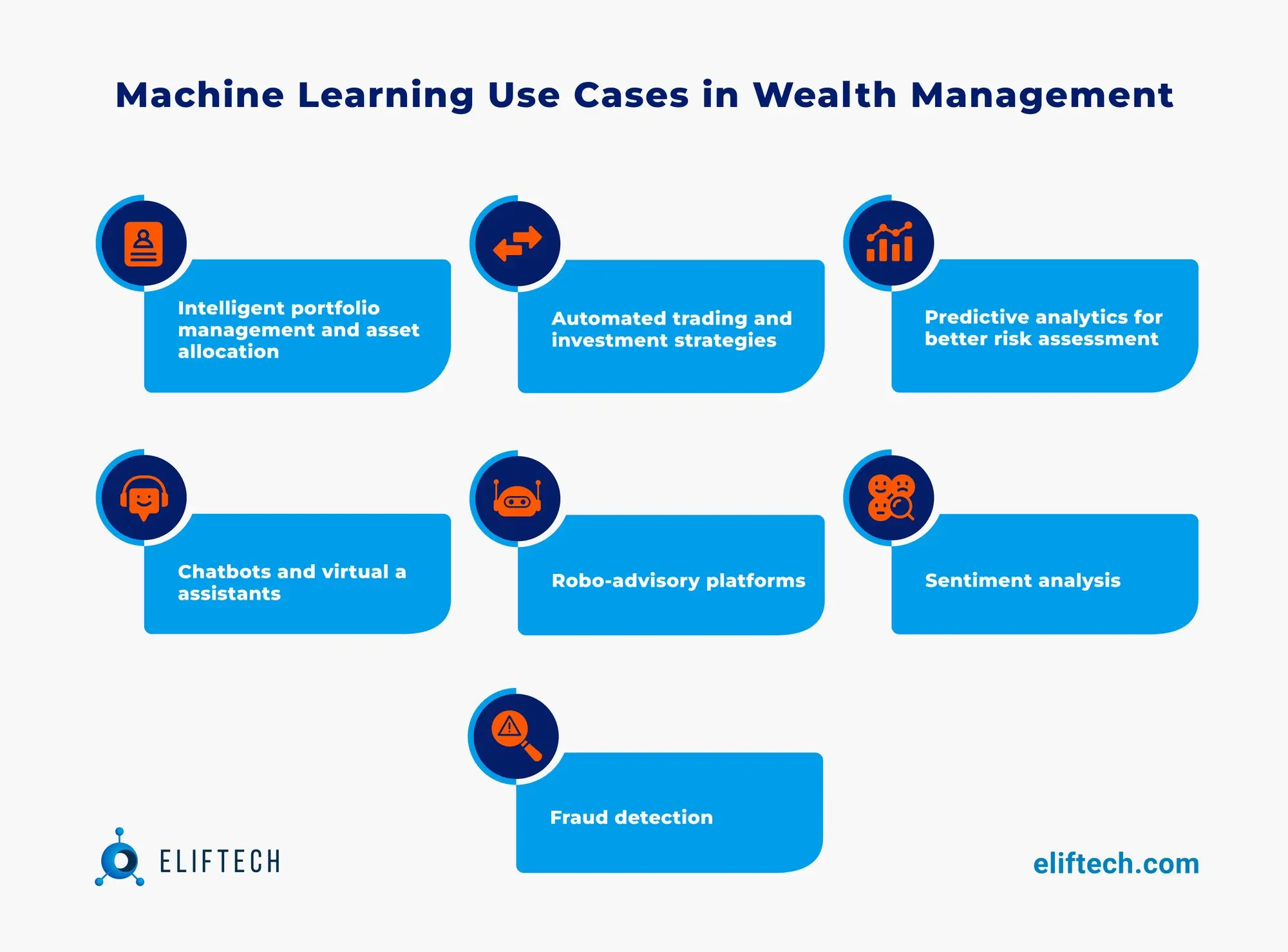

Machine Learning Use Cases in Wealth Management

- Intelligent portfolio management and asset allocation: ML algorithms analyze vast amounts of data and make informed recommendations on asset allocation and portfolio management. This leads to better investment performance.

- Automated trading and investment strategies: AI-powered trading algorithms enable wealth managers to automate complex trading strategies and reduce operational costs.

- Predictive analytics for better risk assessment: Wealth managers use ML techniques to perform advanced risk assessments that help identify potential risks and opportunities early on.

- Chatbots and virtual assistants: Chatbots and other virtual assistant technologies improve client communication, automate routine tasks, and provide personalized assistance.

- Robo-advisory platforms: They leverage ML algorithms to analyze client data, assess risk profiles, and generate investment recommendations. These automated platforms provide cost-effective and accessible wealth management services to a broader range of investors.

- Sentiment analysis: ML techniques can analyze social media posts, news articles, and market sentiment to gauge investor sentiment and identify potential market trends. This information can be used to adjust investment strategies accordingly.

- Fraud detection: ML algorithms can identify patterns and anomalies in financial transactions, helping to detect fraudulent activities. By analyzing historical data, these systems can flag suspicious transactions in real-time, enhancing client security.

Read more: Machine Learning in Ecommerce: How to Boost Your Sales in 2023

The Role of AI Software in Wealth Management

AI software continues to evolve, it plays a transformative role in the wealth management industry, providing companies with cutting-edge solutions that empower them to stay ahead of the competition.

Here are the key areas where AI software is making a significant impact:

Task Automation

By automating repetitive and time-consuming tasks such as data entry, document processing, and trade execution, AI software frees up valuable time for wealth managers to focus on more strategic activities. It streamlines operations, increases productivity, and reduces manual errors.

Real-time Data Insights

AI software enables wealth managers to collect, analyze, and interpret large volumes of wealth management data in real time. This provides them with actionable insights and the ability to make prompt decisions in a fast-paced market. Real-time data analysis gives wealth managers a competitive advantage by enabling them to identify trends, spot opportunities, and mitigate risks more effectively.

AI in Investment Management

AI software empowers wealth managers to build sophisticated investment models and execute smart investment strategies. Wealth managers can optimize portfolio management, improve investment performance, and mitigate risks. Artificial intelligence investment management enables wealth managers to make data-driven decisions and deliver better outcomes for their clients.

Personalized Customer Interactions

AI-powered chatbots and virtual assistants enable personalized and proactive interactions with clients. These intelligent systems can understand customer preferences, provide tailored recommendations, and answer queries promptly, enhancing customer satisfaction and engagement. Personalized experiences enhance customer satisfaction and engagement, fostering stronger client relationships.

Streamlined Compliance and Risk Management

AI software offers robust compliance and risk management capabilities by automating the monitoring of regulatory changes, identifying potential risks, and ensuring adherence to compliance standards. This helps wealth management companies stay compliant while minimizing risk exposure.

Enhanced Fraud Detection and Security

AI algorithms can detect patterns and anomalies, enabling wealth managers to identify potential fraud and enhance security measures. By continuously analyzing data and flagging suspicious activities, AI financial planning software is crucial in safeguarding client assets and maintaining trust.

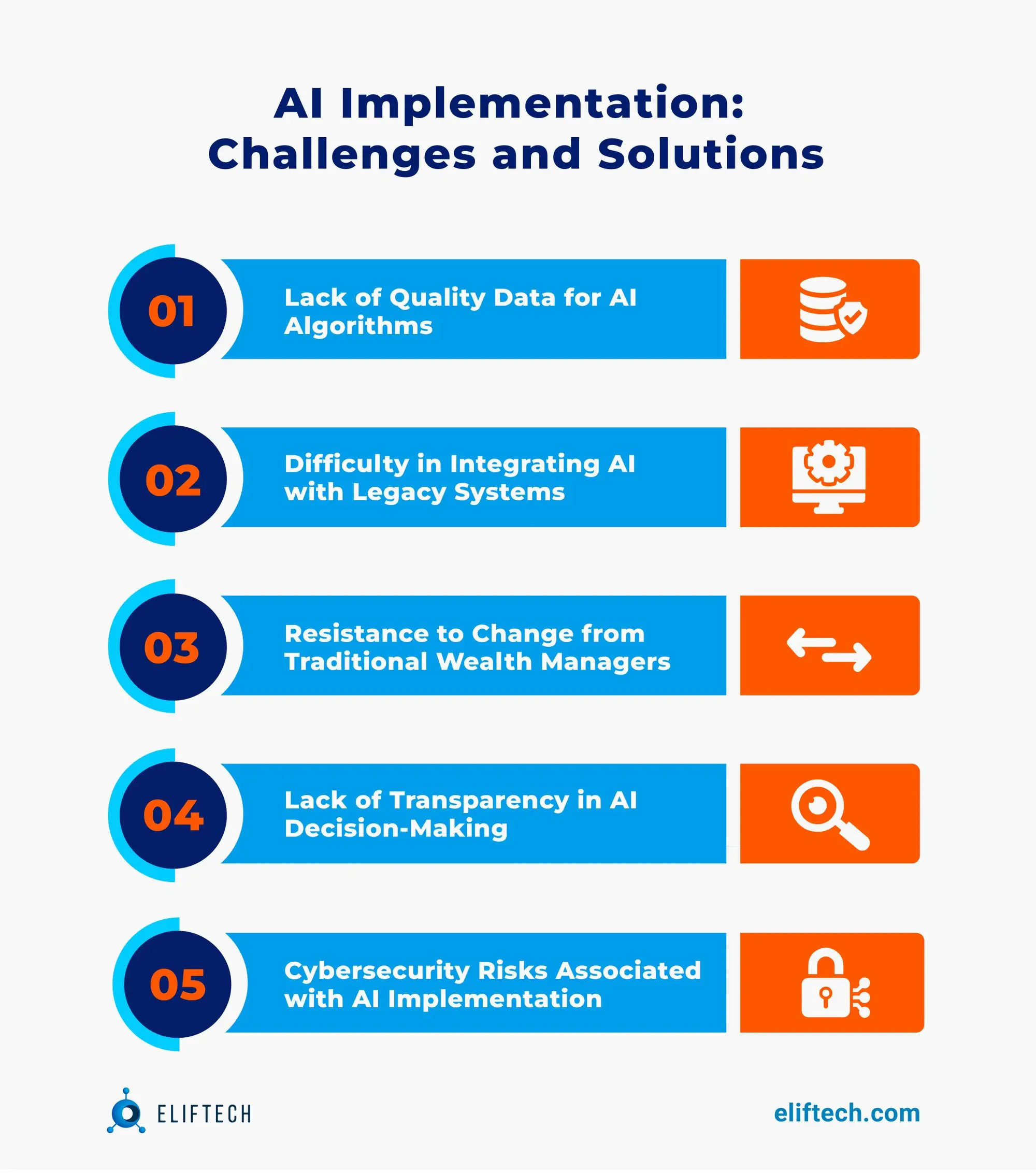

AI Implementation: Challenges and Solutions

Although AI and ML offer significant benefits to the wealth management industry, you may still encounter multiple challenges on your way to their implementation.

Fortunately, each common hurdle has an easy solution to go for:

Challenge 1: Lack of Quality Data for AI Algorithms

AI algorithms rely on high-quality data to provide accurate insights and predictions.

Solution: Implement data quality initiatives, such as data cleansing and enrichment techniques, to enhance the quality and availability of data. Improve data collection methods and ensure proper data governance practices are in place. By investing in data quality, wealth management firms can ensure that AI algorithms have the necessary inputs to deliver reliable results.

Challenge 2: Difficulty in Integrating AI with Legacy Systems

Integrating AI with existing legacy systems can be complex and pose technical challenges.

Solution: Collaborate with a specialized software development company experienced in AI integration. Partnering with experts like ElifTech can ensure seamless integration, compatibility with existing infrastructure, and a smooth transition. Skilled developers can design customized solutions that bridge the gap between AI and legacy systems, maximizing efficiency and minimizing disruption.

Challenge 3: Resistance to Change from Traditional Wealth Managers

Traditional wealth managers may be hesitant to embrace AI due to concerns about job displacement or unfamiliarity with the technology.

Solution: Offer comprehensive training and education programs to familiarize wealth managers with AI and its benefits. Highlight real-life examples of improved outcomes achieved through AI adoption. By demonstrating how AI enhances their roles and provides valuable support, wealth managers can become more receptive to the technology and its potential for growth.

Challenge 4: Lack of Transparency in AI Decision-Making

The opacity of AI decision-making processes can raise concerns about biased or unexplainable outcomes.

Solution: Develop explainable AI models that provide clear rationales for decisions. Incorporate techniques like interpretability algorithms and model explainability frameworks. This allows regulators and clients to understand the decision-making process, ensuring transparency, fairness, and compliance with regulatory requirements. Transparent AI models build trust and confidence in the technology.

Challenge 5: Cybersecurity Risks Associated with AI Implementation

Implementing AI introduces new cybersecurity risks that must be addressed to protect sensitive data and ensure system integrity.

Solution: Partner with a trusted software development company that prioritizes cybersecurity measures. Companies like ElifTech have established protocols and best practices to safeguard AI implementations. They implement robust security measures, conduct thorough risk assessments, and follow industry standards to protect client data and mitigate potential cyber threats. By prioritizing cybersecurity, wealth management firms can leverage AI confidently.

By acknowledging these challenges and implementing the appropriate solutions, wealth management firms can navigate the complexities of AI implementation successfully.

Summary

In 2023, AI in wealth management helps wealth management companies gain a competitive edge in the market.

Partnering with a trusted technology partner like ElifTech can help organizations navigate the complexities of AI implementation and unlock the full potential of these technologies for optimal financial outcomes.

Discover the transformative power of wealth management machine learning with ElifTech.

Browse our case studies and get actionable insights to drive your success

See more